At a Glance: Who Moved to Massachusetts in 2022?

Migration into and out of a state can have serious consequences on the local economy, as migrants can affect the state’s total wealth, taxable income, and overall economic health. In 2022, Massachusetts had a net loss of tax filers – 26,000 more filers decided to leave the state than make it home, taking with them significant troves of taxable income. Even so, many new residents did decide to move to Massachusetts, so where are they coming from?

A large portion of incoming taxpayers understandably come from New England with $1.8 billion of $9.3 billion in total inflow of adjusted gross income (AGI) coming from New England states, according to MassIRSDataDiscovery. Connecticut and New Hampshire were the largest contributors, accounting for $644 million and $562 million respectively. The 5,895 tax filers who came from Connecticut and 6,131 from New Hampshire make up a significant portion of the 78,146 total filers entering Mass in 2022.

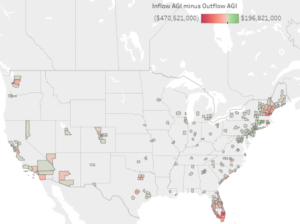

Figure 1: Made from data collected using MassIRSDataDiscovery: 2022

While this represents an increase from the pre-pandemic inflow of AGI from New England ($1.5 billion), net AGI flow shows a different picture. Massachusetts had a net loss of AGI to other New England states of $1.4 billion in 2022, up from approximately $500 million in 2019.

Other than New England, significant areas of AGI inflow for Massachusetts include the census regions of the South, the West, and the rest of the Northeast, totaling respective AGI inflows of $2.1 billion, $1.7 billion, and $2.2 billion. This was driven by New York’s AGI inflow jumping from $863 million in 2019 to $1.35 billion in 2022, Florida’s from $568 million to $1.4 billion, and California’s from $654 million to $1.15 billion.

Figure 2: Made from data collected using MassIRSDataDiscovery: 2022

Interestingly, while Massachusetts did experience growth in taxpayer migration from these states, the scale of new tax filers relocating does not match the significant growth in AGI inflow. Just over 10,000 people migrated from New York to Massachusetts in 2022, up from 8,939 in 2019. Inflow from Florida grew to 6,985 in 2022 from 6,572 in 2019, and California grew from 5,620 to 6,311.

Much of this taxpayer migration occurred between urban areas, though this is likely affected by their large populations. According to MassIRSDataDiscovery, of the 6,311 tax filers who moved from California, 3,411 came from Los Angeles County, San Diego County, San Francisco County, and Santa Clara County. New York follows a similar trend with 4,860 of the 10,004 filers who migrated to MA coming from NYC’s five boroughs. Of the 6,985 filers who migrated from Florida, 2,261 were from Broward County (home of Fort Lauderdale), Miami-Dade County, Orange County (home of Orlando), and Palm Beach County.

Figure 3: Shows counties where AGI is coming and going to MA, MassIRSDataDiscovery: 2022

Many people entering MA also settle in urban or suburban areas. According to MassIRSDataDiscovery, of the about 78,000 filers who migrated to Massachusetts in 2022, 22,717 went to Middlesex County, 15,802 to Suffolk County, and 7,102 to Norfolk County, totaling 45,621 people (58 percent of total inflow).

Importantly, inflow from these states is only part of the picture. MassIRSDataDiscovery reports that, overall, Massachusetts gained $78 million in AGI from California but lost 2,023 taxpayers to it in 2022; lost $1.46 billion in AGI and 7,033 taxpayers to Florida; and 7,033 taxpayers as well as $122 million in AGI and 461 citizens to New York. In comparison, in 2019, Massachusetts gained a net 370 citizens and $168 million from New York, lost a net 2,439 citizens and $190 million to California and a net 3,694 citizens and $712 million to Florida. These losses contributed to a total net loss of $3.9 billion in AGI and 26,326 taxpayers in 2022.

About the Author: Raif Boit is a Roger Perry Transparency Intern at Pioneer Institute for the summer of 2024. He is a rising freshman at Harvard College.