After nearly a decade of national economic growth, Worcester economy is still a mixed bag

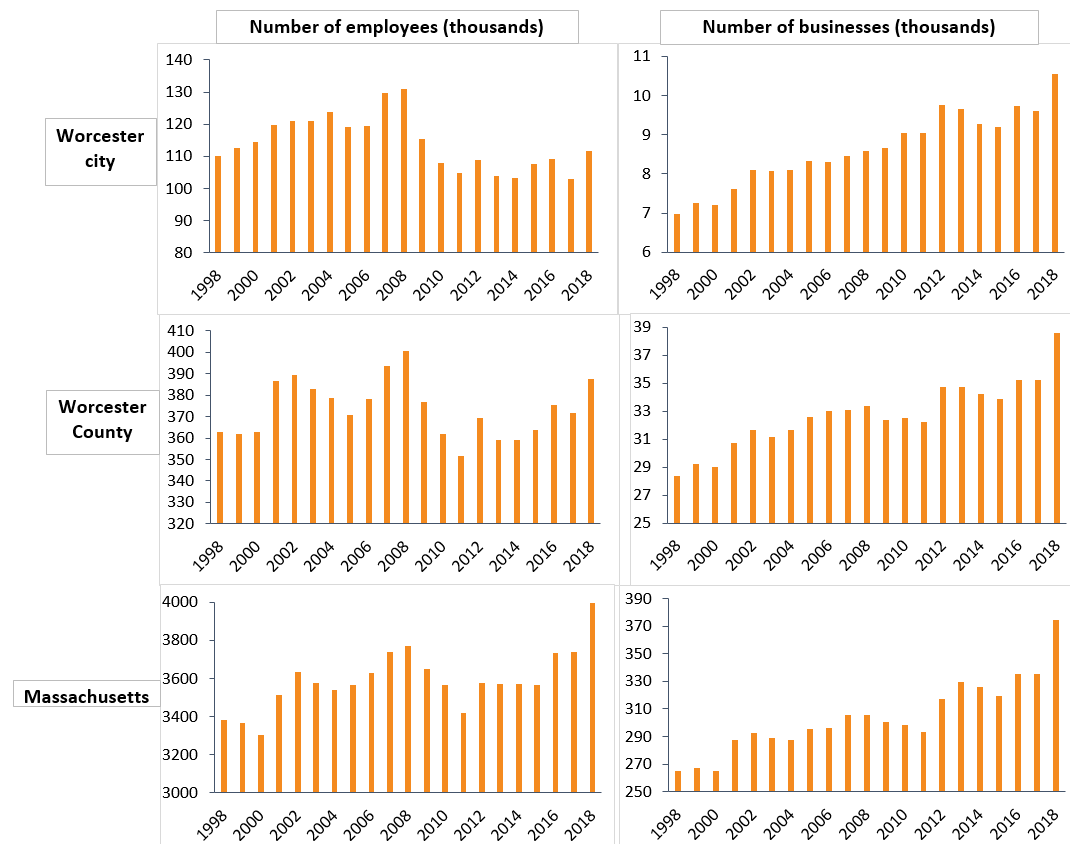

In 2018, Worcester had 111,553 employees and 10,546 businesses. The number of businesses grew by 51% from 1998 to 2018, while the total number of employees increased by 1% (see Figure 1 below). However, the number of employees in the city declined by 20% between 2008 and 2011, which largely coincides with the Great Recession. Employment growth in Worcester has generally been positive since the end of the recession, keeping pace with population growth.

Figure 1: Trends in the number of employees and number of businesses in the city of Worcester, Worcester County, and Massachusetts as a whole

Overall, trends in business and employment growth in Worcester closely resemble those of the state as a whole. From these figures, there is some evidence that the 2008 recession had more of an impact on Worcester than on the state as a whole, but perhaps more concerning is the city’s relatively slow recovery. Employment in most of Massachusetts has grown over the present period of economic expansion (2010-2018), while in Worcester it is relatively stable. This may be attributable to the recent struggles of some of Worcester’s more specialized industries.

The decline of manufacturing jobs is an oft-cited concern in formerly industrial cities like Worcester, but in reality such a trend began well before the 2008 recession. The decline in white collar industries like health care, professional services, and STEM is more uniquely prevalent in a post-recession context. In a hot economy, Worcester has struggled to compete with other regional innovation hubs like Cambridge and Waltham. Worcester has also seen recent contractions in the retail and finance sectors, but this is more on par with the state as a whole. Hopefully, projects like the redevelopment of the Worcester State Hospital site will help reverse these trends.

In the meantime, employment growth in local services, transportation, and recreation has worked to offset the struggles of Worcester’s professional and retail sectors (see Table 1 below).

Table 1: The top industries in Worcester by employment, including recent growth figures

Overall, the health care and education industries seemed to drive growth in Worcester in the late 1990s and 2000s, but each of these industries has failed to create more net jobs since the 2008 recession. In fact, each of Worcester’s top 5 industries by employment lost jobs from 2008 to 2018. In the face of continued overseas competition in manufacturing and increasing automation in the retail sector, Worcester will have to invest in more specialized industries, such as STEM and finance, in order to build a more resilient economy going forward.

More information on business trends, whether by industry, geography, or in the aggregate, is available at MassEconomix.com.

Andrew Mikula is the Lovett & Ruth Peters Economic Opportunity Fellow at the Pioneer Institute. Research areas of particular interest to Mr. Mikula include urban issues, affordability, and regulatory structures. Mr. Mikula was previously a Roger Perry Government Transparency Intern at the Institute and studied economics at Bates College.