Study Finds Pension Obligation Bonds Could Worsen T Retirement Fund’s Financial Woes

A new study published by Pioneer Institute finds that issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

Study: Pandemic Pension Bonus Bills Would Cost Billions and Unfairly Favor Highly Compensated Public Employees

Two identical bills to reward public employees with a retirement credit bonus for working during the COVID-19 emergency are currently pending in each chamber of the Massachusetts Legislature. The bills would add billions of dollars in liabilities to public pension funds and reward workers based on their compensation, years of service and age rather than the type or duration of the work performed during the emergency, according to a new study published by Pioneer Institute.

Public Statement on the MA Legislature’s Blanket Pension Giveaway

Beacon Hill just put on full display what happens when it is awash in money. House Bill 2808 is entitled, “An Act relative to providing a COVID-19 retirement credit to essential public workers.” It calls for adding three years of additional retirement credit to state “employees who have volunteered to work or have been required to work at their respective worksites or any other worksite outside of their personal residences during the COVID-19 state of emergency…” But upon reading the brief bill, it quickly becomes clear that this legislation is irresponsible in the extreme.

Whistleblowers Were Proven Right: MBTARF Was Underreporting Its Unfunded Pension Liabilities

In a new brief, Pioneer shows that whistleblowers’ 2015 claim…

Study Says State Unfunded Pension Liability Rising Despite Recent Reforms, Overall Strong Economy

More responsible assumptions about pension fund investment performance…

So you want to know something about pensions?

0 Comments

/

Now anyone can become a local pension system expert...

A…

Study Estimates $27 Million In Savings Annually From Consolidation Of Public Pensions

Local retirement systems generate heavy costs, larger fiduciary…

Study: Evidence Suggests MBTA Pension Low-Balled Costs And Liabilities

Quarter-century of data shows costs at up to six times valuation…

Study: Inefficient Public Pension Investment Costs Taxpayers About $100 Million A Year

Local systems forfeited some $2.9 billion over 30 years by not…

Study: T Pensions Would Be Worth $902M More Had Assets Been Managed by State Pension Fund After 2000

MBTA would have saved $676 million, T pensions would have been…

A $49 Million Sweetheart Deal: MBTA Employee Sick Time Perk Enhances Pensions

Listen to the WRKO radio clip of Mary Connaughton interviewed…

Study: Massachusetts Public Pension Systems Unprepared for Next Recession

Actuarial assumption adjustments clarify which funds are troubled…

STUDY: MA Public Pension Systems Unprepared for Next Recession

Actuarial assumption adjustments clarify which funds are troubled…

Study: “Fair Market Valuation” of Pension Liabilities Neither “Fair” Nor “Market”

Study Shows “Fair Market Valuation” of Pension Liabilities…

Study: Public Pension Liabilities Are Undervalued by Tens of Billions of Dollars

Historical Market Performance of Asset Classes Held by Retirement…

Study: MBTA Retirement Fund Failings a Cautionary Tale

Study Finds Poor Governance Structure, Lack of Accountability…

The End of the Line for the MBTA Retirement Fund?

Without Taxpayer Support, MBTA Retirement Fund Would Become Insolvent…

Study Calls for MBTA Employees to Be Transferred to State Pension System

Despite claims to the contrary, overly generous benefits, early…

MA Retirement Systems in Critical Condition, Fiscal Risks Remain High

Expert Testimony: Several Retirement Systems in Critical Condition,…

Delaying the Funding of Public Pensions May Cost up to $26.4 Billion

State leaders’ 2010 decision to postpone the deadline for full funding of the state and teachers’ retirement systems from 2025 to 2040 may cost taxpayers up to $26.4 billion.

Have the MBTA’s Retirement Plans Gone Off the Rails?

Study Finds Lack of Transparency and Chronic Underfunding Among…

Study: GASB Rules Improving, But Still Need Measured Reform

Study Finds Further Reform of GASB Rules Necessary, But Must…

Cost of COLAs in Massachusetts Public Retirement Systems

Study Finds Increased Pension COLA Will Require Communities to…

Consolidating Public Pension Administrations Could Save $27M Annually

REVISED STUDY FINDS THAT CONSOLIDATING ADMINISTRATION OF PUBLIC…

Have the T’s Retirement Plans Gone Off the Rails?

Study Finds Financial Condition of MBTA Retirement Plan Deteriorated…

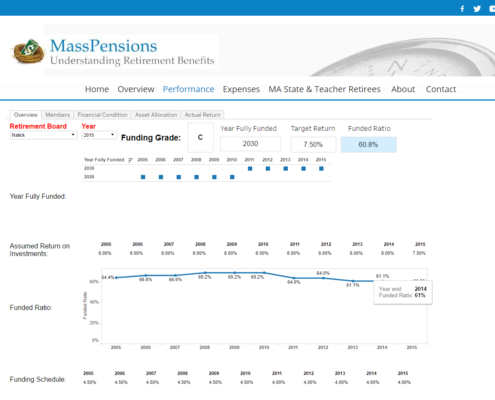

Introducing MassPensions.com – New Site Rates MA’s 100+ Pension Systems

User-Friendly Online Tool Provides Easily Accessible Data, Rates…

Improving the Bay State’s Public Pension Fund Investment Policies

While current policies provide a solid basis for preserving assets in Massachusetts’ 105 public pension funds, improvements and updates would boost flexibility and investment returns, while promoting accountability and limiting unnecessary risks, according to a new study published by Pioneer Institute.

Unrealistic Investment Return Assumptions Mask True Cost Of Retiring Unfunded Pension Liabilities

Pension boards across Massachusetts must use more rigorous actuarial assumptions about pension fund investment returns and accelerate the rate at which they pay down unfunded liabilities to meet the 2040 statutory deadline for fully funding public pensions in the Commonwealth according to a new study published by Pioneer Institute, The Fiscal Implications of Massachusetts Retirement Boards’ Investment Returns.