Study: Public Pension Liabilities Are Undervalued by Tens of Billions of Dollars

Historical Market Performance of Asset Classes Held by Retirement Funds Indicates Public Pension Liabilities Are Undervalued by Tens of Billions of Dollars

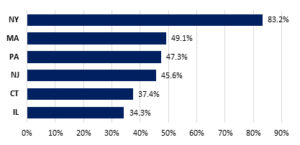

Assets in pension funds’ portfolios have historical market returns of 6-7 percent annually rather than 7-8 percent typically assumed; state pensions in Massachusetts about as funded as in New Jersey and Pennsylvania, Connecticut’s actual funding levels close to Illinois’s

BOSTON – Most public pension funds assume rates of return inconsistent with their portfolio allocations and many invest heavily in low-yield assets such as fixed income and real estate, according to a new study published by Pioneer Institute.

Market Rates of Return for Effective Financial Management

The report, entitled “Market Rates of Return for Effective Financial Management,” shows pension liabilities are underestimated by tens of billions of dollars across more than thirty major retirement systems in Connecticut, Illinois, Massachusetts, New Jersey, New York and Pennsylvania. Unrealistic return assumptions and inefficient portfolio management are a major cause of higher pension costs and underfunding, second only to governments’ not making their required contributions.

“To be responsible about their retirement systems, states and localities should not use discount rates inconsistent with pension funds’ portfolio allocations,” said Iliya Atanasov, Pioneer Institute senior fellow on finance and author of the report. “For a typical plan, that implies a reduction of assumed rates of return from 7.5 to 6.5 percent and increasing annual contributions accordingly to put us on a more reliable course to full funding.”

Figure 1: Select state systems’ implied asset returns and funding levels around FY 2013 (dollars in millions)

| State | Return by historical market data | Unfunded liability | Funded ratio |

| Connecticut | 6.57% | $39,897 | 37.4% |

| Illinois | 6.46% | $131,065 | 34.3% |

| Massachusetts | 6.12% | $46,257 | 49.1% |

| New Jersey | 6.23% | $93,271 | 45.6% |

| New York | 6.64% | $52,470 | 83.2% |

| Pennsylvania | 6.08% | $84,746 | 47.3% |

Figure 2: Funded ratio of select states’ systems

When more realistic rates of return are applied, the unfunded liability of Massachusetts’s state and teachers’ pension plans increases from about $26 billion to more than $46 billion, a $20 billion jump that is equal to about two thirds of official state debt. The adjustment reveals that the teachers’ retirement fund is in particularly dire condition, with a funded ratio of only 43 percent.

In Illinois, historical market returns imply a total unfunded liability for Chicago and Cook County of $45 billion, $8.8 billion more than official figures. Four Chicago pension plans are funded at 33 percent on a weighted-average basis, while three county retirement systems are funded at 46 percent. Given the city’s revenue base, it seems implausible that the plans can remain solvent without cuts in current benefits.

The same applies to Illinois’s employees’, teachers’ and universities’ retirement systems, which are underfunded by $131 billion in total.

New Jersey is a close second among the six states in overall unfunded benefits, with a $93.3 billion shortfall across five open retirement systems, $44 billion more than reported by the state. Pennsylvania’s two main state systems – employees’ and school districts’ – follow narrowly, with total unfunded liabilities of $84.7 billion, $37 billion more than official figures.

Five state-managed retirement systems in Connecticut have a consistently high discrepancy between historical market performance and assumed asset returns – 6.57 percent versus 8.25 percent, respectively. At market rates of return, the five plans held enough assets to fund about 37 percent of liabilities, coming short by nearly $40 billion and surprisingly close to Illinois state systems’ aggregate funded ratio of 34 percent.

New York’s plans were the best funded among the six states – at 83 percent on average – and had a relatively low discrepancy between assumed and historical market returns of about 100 basis points. Even so, the state had a total unfunded liability of $52.5 billion as of fiscal 2013, $19.2 billion more than official figures.

Four pension plans in the City of New York assuming 7 percent annual returns were the only major systems without a substantial deviation from historical asset-market performance. The plans were funded at 58 percent in the aggregate, with a total unfunded liability of about $60 billion.

“Shifting more of pension funds’ assets from fixed income into equities can increase MRRs to about 7 percent,” Atanasov said. “Another option is to focus on reducing the fees paid to consultants and investment managers by ensuring more competitive and transparent contracting and divesting systematically underperforming assets such as so-called hedge funds. But in many states benefit cuts even for current retirees probably cannot be avoided.”

The prevailing methods used to arrive at an ARR are often based on implausible assumptions, unreliable statistical techniques and arbitrary predictions. While past performance should not be taken as a predictor of future returns, MRRs provide an objective and stable discount rate that is not influenced by politics or yesterday’s market fluctuations.

The Pioneer white paper is accompanied by an MRR Calculator utility that allows a user to determine MRRs from publicly available data on asset returns by inputting fund portfolio allocations.

[wpdm_package id=429]

MRRs would allow financial managers to focus on stress-testing funding schedules, preparing for the impact of future securities market shocks on state and local budgets, and devising better investment policies rather than trying to predict the future.

In addition to improving financial management, standardized application of the MRR Calculator to the 105 public pension systems in Massachusetts and other public systems would boost transparency and make it easy for bondholders and plan members to compare the financial condition of various pension plans.

About the Author

Iliya Atanasov is Pioneer’s Senior Fellow on Finance, leading the research tracks on pension management, data analysis and municipal performance. He is a PhD candidate in Political Science and Government and a former Presidential Fellow at Rice University. He also holds BAs in Business Administration, Economics and Political Science/International Relations from the American University in Bulgaria.

###

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.