Part II: Push and Pull Factors for Massachusetts Businesses

Unemployment Insurance Tax Effect on Massachusetts Businesses

In Part I, I explored the differences in unemployment insurance (UI) benefits between Massachusetts, Connecticut, and New Hampshire. Based on the weekly benefit caps and number of weeks a claimant is eligible to collect, Massachusetts is the most desirable state of the three in which to be unemployed. While clearly beneficial for claimants, how might generous UI benefits impact Bay State businesses?

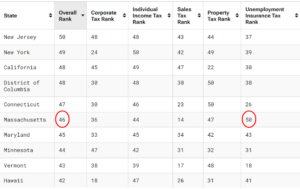

According to the Tax Foundation, a Washington D.C. think tank, from 2019 to 2024, Massachusetts ranked last among the states for the worst UI taxes. Granting claimants generous benefits comes at a high cost to employers operating in the state. Several factors place Massachusetts at the bottom of the ranking.

Figure 1: Tax Foundation

First is the maximum unemployment tax rate. To put this issue in perspective, eight states have a maximum rate of 5.4 percent – making them the most desirable places for businesses to operate according to this measurement. Massachusetts had the highest maximum rate at 19.57 percent. Taxable wage base (TWB) also plays a role in determining the effect of unemployment insurance tax on businesses. Massachusetts’ taxable wage base is $15,000, meaning the state can tax the first $15,000 of an employee’s annual wages for unemployment insurance. There are 19 states that have a higher TWB than Massachusetts, but in almost every case, their UI tax rate is significantly lower.

Massachusetts rates the worst for unemployment insurance tax, and it doesn’t do much better in terms of overall business taxes. According to the Tax Foundation, Massachusetts ranks 46th for the worst business tax climate in 2024. Yet, if the taxes are so high, why do so many businesses choose to stay?

The Benefits of Operating in Massachusetts

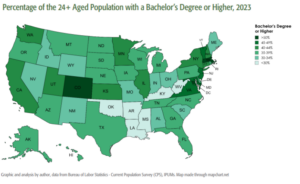

Massachusetts’ labor force is the most highly educated in the nation, something that is attractive to businesses. Nationwide, 26.9 percent of the labor force has a bachelor’s degree or higher. According to the 2024 labor force report published by Pioneer Institute, 52.1 percent of Massachusetts residents over the age of 24 have a bachelor’s degree or higher. The graph below shows that only Colorado and DC rank over 50 percent in this metric. The numbers are likely to be explained by some of the top universities in the nation – arguably the world – calling Boston home. In fact, a 2017 MassEcon study found that “96 percent of companies chose Massachusetts for the quality of its workforce.” Businesses seeking individuals for highly skilled positions are going to have the largest potential pool of employees if they are operating in Boston.

Figure 2: Pioneer Institute’s Labor Report

Massachusetts is one of the most innovative states in the nation, another factor that is compelling when businesses are making location decisions. Innovation is a vital component of economic growth, and Boston, with its educational and research success, boosts Massachusetts to the top of the list in innovation. Although taxes can be a push factor that threatens a state’s competitiveness and leads businesses to consider operating elsewhere, the pull factor of the economic powerhouse that is Massachusetts is – for now, anyway – often stronger.

Dana DiChiro is a Roger Perry Government Transparency Intern at the Pioneer Institute for Summer 2024. She is a rising senior studying Government & Politics and Economics at the University of Maryland, College Park.