Boston companies can partner with public universities to create fintech skills pipeline

/0 Comments/in Higher Education, Oped: Education /by Eamon McCarthy EarlsRead this op-ed in the Boston Business Journal.

Financial technology, or fintech, encompasses a variety of new technologies, including algorithmic asset management, thematic investing, and cryptocurrency, which are set to have a significant impact on the 200,000 workers in the Massachusetts finance and insurance industries. Last year, The Boston Business Journal reported that finance and manufacturing were the only two industries in Boston that experienced declining headcounts—finance due in part to more automated fintech processes. Opimas, a consulting firm, indicates that 90,000 asset manager jobs will be automated by 2025, potentially spelling bad news for many asset management professionals in Boston’s own Financial District.

This and other alarming statistics, such as projected 60 percent declines in profits for companies that fail to implement fintech, as reported by McKinsey & Company, indicate that financial firms need to be preparing for the future. In a new report prepared for the Pioneer Institute, a Boston-based public policy think tank, I explored how public universities can boost skills and prepare students to meet the shifting demands of the industry in our region. But the responsibility to adapt rests with businesses as well.

Because fintech is new, there is often a lack of teaching material and expertise about it. Universities are inviting fintech executives to speak, and companies could do the same for internal training. Some leading private universities in the US, such as MIT, Harvard, Brandeis and others, together with schools internationally, are crafting fintech tracks and courses, and faculty at the Commonwealth’s public universities, such as UMass Boston and UMass Amherst, are joining the effort.

Boston firms will need to retrain many of their workers as well as rely on a steady supply of talent coming from our state universities. A collaborative approach to working with academia will help to boost the pipeline. Design thinking, communication and collaboration skills, as well as a broad understanding of the scope of new technology are very important for adapting the workforce for future demands. Project managers and other professionals combining business and technical aspects might focus on sharing insights with students. Even accountants adopting new ways of valuing businesses based on intellectual property could share their methodologies with students. Firms could also design internships for undergraduate and graduate students focused on implementing fintech in the real world. As universities chart a course toward the fintech future, Boston financial firms must do the same and join them on the journey.

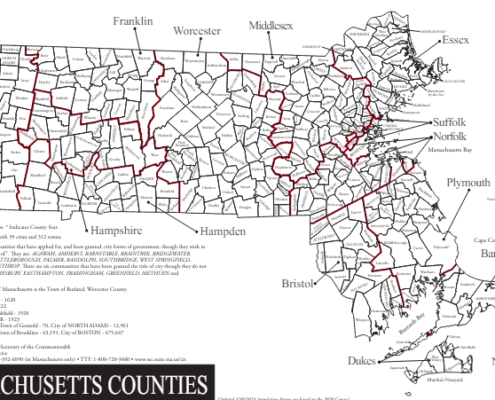

Eamon McCarthy Earls is a writer, researcher and town councilor in Franklin, Massachusetts.

Get Updates on Our Economic Opportunity Research

Read Pioneer’s recent report, Preparing Students for a Future in Fintech.

Related posts:

What’s Included in Massachusetts’ $5.2 Billion Housing Bond Bill?

The Largest Groups Driving Massachusetts’s Migration

Pioneer Institute Statement on the Project Labor Agreement Provision in the Massachusetts Economic Development Bill

Massachusetts Affordability and Competitiveness Ranking is in Freefall

Migration to Massachusetts in 2022: Where Are People Going?