Disparities in LIHTC Data Illuminate Difficulties in Housing Production

Massachusetts needs all the help it can get when it comes to bringing the exorbitant price of housing down and making the state more affordable. State policymakers have attempted many different interventions over several years to facilitate housing construction and decrease prices.

Among these efforts are tax credits, both state and federal, that are aimed at easing the cost of building housing targeted towards low-income first-time buyers and renters. The Low-Income Housing Tax Credit (LIHTC), a federal initiative, is one of these tax credits. LIHTC has been heralded by some Massachusetts policymakers as a key mechanism for spurring development.

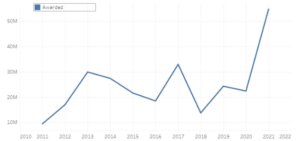

LIHTC Awards

Using data from Pioneer Institute’s MassOpenBooks data transparency tool, it appears that funding for LIHTCs has been rising. In 2011, Massachusetts awarded about $9.5 million in LIHTCs. In 2020, that number increased to about $22.5 million, and in 2021 it was just under $55 million. Despite some fluctuation since 2011, the increase in funding for LIHTCs shows that Massachusetts policymakers view it as a useful policy lever for reducing housing costs. This trend has continued beyond 2021, as funding for LIHTCs has been expanded even more.

Figure 1. LIHTC awards

Disparity Between Awards and Issuances

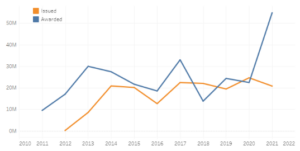

There are also data on how much LIHTC money has been formally issued. There is a distinction between the amount awarded and issued for LIHTCs, as they are one of the Massachusetts tax credits that involve both an awards process and an issuance process. Taxpayers can be awarded a tax credit during the preparatory stages of a project, but they will not be formally issued a credit until they successfully apply for an issuance from the Executive Office for Housing and Livable Communities (EOHLC) after construction has commenced.

Despite the fact that the amount of money awarded in the form of LIHTC has been increasing, this trend is not necessarily mirrored by the amount of tax credits that have been issued in a given year. In 2014, the state issued just under $21 million in LIHTC. By 2020, that amount had increased slightly to about $24.5 million. And despite awards growing by over $30 million between 2020 and 2021, the amount of LIHTC money issued fell to less than $21 million.

Figure 2. LIHTC issuances

Figure 3. LIHTC awards and issuances

Other Factors

It is important to note that this is to be expected, as it is normal for tax credits that have been awarded to not be issued until the following year or later. Construction projects take a long time, so the tax credit issued for a particular project may not be reflected in the data for the same year the credit was awarded. But the disparity in data here illuminates the susceptibility of LIHTC to not be as effective as some may project.

LIHTC awards can also outpace issuances due to well-publicized problems such as high materials costs or restrictive zoning. Raising the cap on LIHTCs and other tax credits may be a noble pursuit, but the increase in funds ultimately does not account for other very impactful inhibitors to housing construction. A credit may be awarded to a taxpayer, but if there are construction delays, which have become common, it may be a while before that tax credit is formally issued.

Furthermore, the lag can lead to resources allocated for a given year being used to fill gaps in existing projects rather than funding new ones. This was evident in a 2017 Jamaica Plain development that was delayed for several months and needed additional funding to complete.

Conclusion

While we don’t have data for the past few years, housing prices are still very high. The effects of increasing the funds for LIHTC won’t be fully understood for some time, but factors outside of funding may make the seemingly never ending increase in housing costs immune to LIHTC’s impact. Development does not seem to be getting any easier, and it appears that the 2021 LIHTC funding increase may be a drop in the bucket compared to what is needed to combat the effects of other culprits behind rising housing prices.

About the Author

Matt Mulvey is a Roger Perry Transparency Intern at the Pioneer Institute. He is a rising senior at Swarthmore College where he is a political science major and history minor.