Telehealth Progress Slowed in 2023

A new report by Cicero Institute, Pioneer Institute, and Reason Foundation reveals worrying stagnation in state-level telehealth expansion efforts in 2023, with only a few exceptions. Progress made during the pandemic is being lost even as provider shortages worsen, raising concerns about patients’ access to care.

As COVID-19 Emergencies Ease, Some Progress on Telehealth Rules

A new report from Reason Foundation, Cicero Institute and Pioneer Institute rates every state’s telehealth policy for patient access and ease of providing virtual care. The report highlights telehealth policy best practices for states.

Study: Massachusetts Should Retain Additional Healthcare System Flexibility Granted During Pandemic

Massachusetts’ emergency declaration for COVID-19 ends on June 15, and with it some enhanced flexibility that has been allowed in the healthcare system. Some of the added flexibility highlighted barriers that make the system more expensive, harder to access and less patient-centered, and the Commonwealth should consider permanently removing these barriers, according to a new study published by Pioneer Institute.

Study: Massachusetts Should Embrace Direct Healthcare Options

Especially in the COVID era, many are looking to alleviate the increased burden on the healthcare system. One solution is direct healthcare (DHC), which can provide more patient-centered care at affordable prices and is an effective model to increase access to care for the uninsured, underinsured and those on public programs like Medicaid, according to a new study published by Pioneer Institute.

Public statement on new federal rule eliminating “skimming” of dues from caregivers’ Medicaid payments

Pioneer Institute applauds a new rule announced by the U.S. Centers…

Study Finds MassHealth’s Enhanced Eligibility Verification Saves $250 Million a Year

Reforms fixed MassHealth's $1.2 billion eligibility crisis, freed…

Pioneer Experts Offer Contrasting Prescriptions For MA Healthcare

BOSTON - New policy briefs from Josh Archambault and Barbara Anthony, two senior fellows in healthcare at Pioneer Institute, offer differing prescriptions for how Massachusetts should navigate uncertainty in the healthcare market, as Congress debates the fate of the federal Affordable Care Act (ACA).

With Federal Health Law Facing Repeal, New Book Offers Alternative

U-Turn: America’s Return to State Healthcare Solutions

(114…

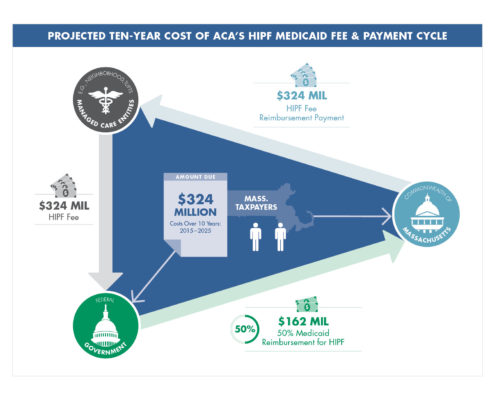

New ACA-Related Medicaid Fee Will Cost MA $162M+ Over Next Decade

Read news coverage of this report in The Boston Globe.

Health…

Study: $1B Price Tag for ACA Health Exchange & New Medicaid Program in Mass.

Study: $1 Billion Price Tag for ACA Health Exchange & New…

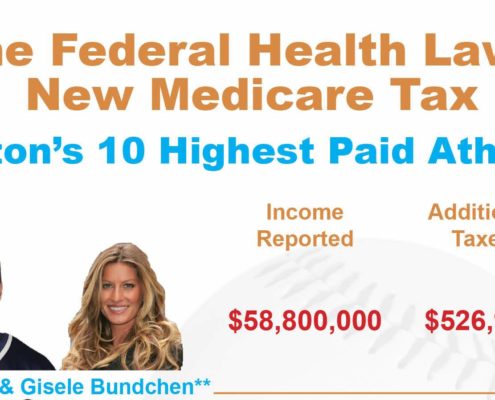

ACA Medicare Payroll Tax Costs MA $1.7B Over 10 Years; 3 Patriots to Pay $707,850 in 2013

ACA also includes additional 3.8% Medicare tax on net investment…

Pioneer Requests Report That Predicts ACA’s “Extreme Premium Increases”

1 Comment

/

Pioneer Files Request for the Administration to Release Its Report…

Big “Cadillac Tax” Ahead for Massachusetts’ Middle Class

A new brief from Pioneer Institute, The Impact of the Federal Health Law’s “Cadillac Insurance Tax” in Massachusetts, estimates additional costs associated with the ACA's so-called "Cadillac tax," will affect well over 50% of workers in Massachusetts.