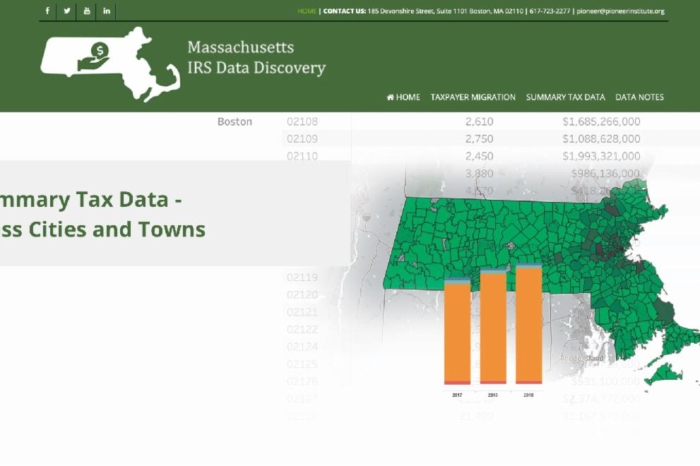

NEW: MassWatch IRS Data Discovery Tool

If you want a window into taxation, to learn where Massachusetts residents move to and where new residents are coming from, Pioneer Institute has an innovative research tool for you. With Pioneer’s new Mass IRS Data Discovery Tool, you can now compare state-to-state or year-to-year tax data without downloading up to 2,000 IRS files in many different, cumbersome formats.

Since the early 1990s, the IRS has posted spreadsheets on its website that document aggregated and anonymized 1040 tax returns, including taxpayer migration and individual income tax data. Pioneer’s new IRS Data Discovery Tool has uploaded all of these files to a single database, ensuring consistency of format, and has connected the data to user-friendly applications for easy analysis and visualization.

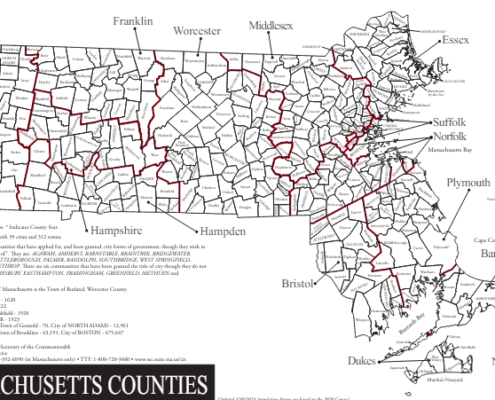

The individual tax statistics show selected income and tax items classified by county, ZIP code and income bracket. The data are from the IRS’s Individual Master File, which includes a record of every Form 1040, 1040A, 1040EZ, 1040PC, 1040 NR and 8814 filed with the IRS. Additionally, our site allows you to research Massachusetts migration trends by county, both interstate and intrastate.

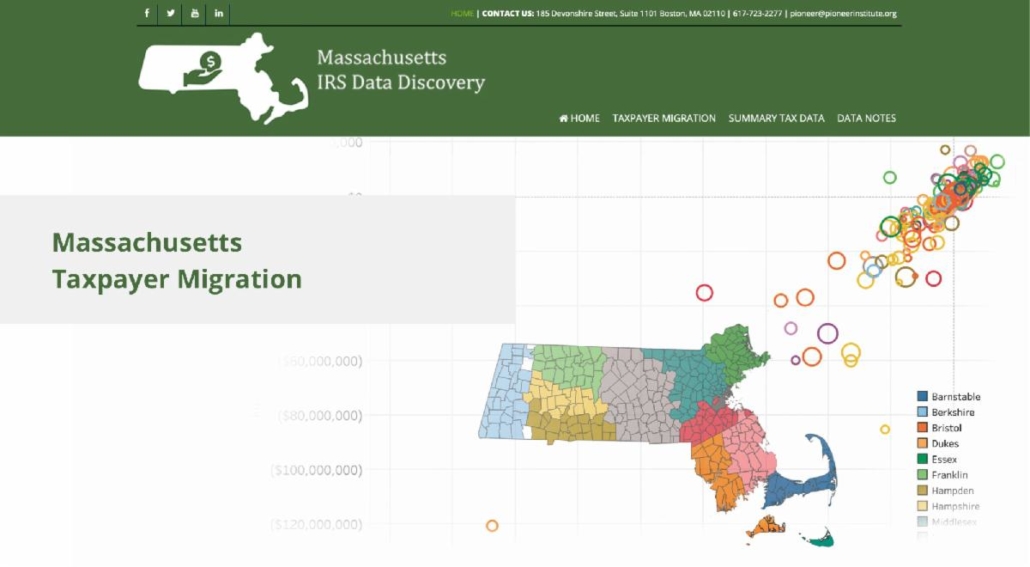

Migration data for the United States are based on year-to-year address changes reported on individual income tax returns filed with the IRS. They present migration patterns by state or by county for the entire United States and are available for inflows—the number of new residents who moved to a state or county and where they migrated from, and outflows—the number of residents leaving a state or county and where they went. The data are available for Filing Years 1993 through 2019 and include:

- Number of returns filed, which approximates the number of households that migrated

- Number of personal exemptions claimed, which approximates the number of individuals

- Total adjusted gross income, starting with Filing Year 1995

- Aggregate migration flows at the State level, by the size of adjusted gross income (AGI) and age of the primary taxpayer, starting with Filing Year 2011.

The IRS Data Discovery Tool is the latest offering from MassWatch, Pioneer’s suite of free data resources that promote citizen engagement in state and local government. It is near impossible to maintain a healthy democracy without public access key information. The free websites that make up MassWatch provide access to vast amounts of data with user-friendly queries to foster public particiaption in government.

Analysis from Pioneer’s Transparency Team: