Understanding the Trends in Massachusetts’ Sin Tax Revenues

Aimed at discouraging certain kinds of behavior and increasing government revenues, sin taxes are taxes on goods and services that society deems to be harmful or immoral. The taxes that fall under the sin tax umbrella include those on alcohol, cigarettes, nicotine, marijuana, and gambling. Pioneer Institute’s MassOpenBooks data transparency portal shows how much revenue Massachusetts has raked in through these taxes.

Alcohol, Cigarettes, Nicotine

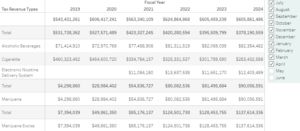

Revenue from taxes on alcoholic beverages have steadily increased in the last five years. In 2019, Massachusetts brought in just over $86 million in taxes on alcoholic beverages. That number increased each year through 2023, as the Commonwealth garnered over $98 million in alcoholic beverage taxes.

Revenues from cigarette taxes have gone in the opposite direction. In 2019, Massachusetts brought in over $553 million in tax revenues from cigarettes. But that amount has steadily declined since, and in 2023, total cigarette tax revenue was about $365 million, down 34 percent from 2019.

Tax revenue from electronic nicotine delivery systems, such as vape devices, have only been accounted for since 2021, when the state brought in over $13 million in tax revenue courtesy of these devices. That number increased to over $16 million in 2022, but fell back down to just under $14 million in 2023.

Marijuana

Tax revenues from marijuana have skyrocketed since 2019. Back then, revenues from the marijuana sales tax, which applies to wholesale marijuana transactions, were just over $8 million. In 2023, that number jumped almost 12 fold to over $93.5 million.

Revenues from the marijuana excise tax, which applies to transactions between retailers and individual customers, have seen a similar trend. The 2020 total was over three-and-a-half times greater than the 2019 total, and the 2021 total was more than double the 2020 total. The rate of increase has slowed a bit in recent years, but the 2023 revenue from the marijuana excise tax amounted to over $161 million.

Gambling

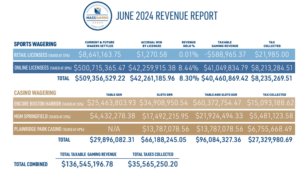

Since casino-style gambling began in Massachusetts in 2015, the state has collected over $1.6 billion in taxes and assessments. In June of 2024 alone, the state collected over $35 million in tax revenues from gambling.

Additionally, revenues have substantially increased with the introduction of legalized sports betting. In the first 18 months of legalized sports betting, it generated over $128 million in tax revenues for the Commonwealth.

Looking Ahead

MassOpenBooks does not have tax revenue data for all of fiscal year 2024, but the data is updated for the first 10 months of the fiscal year. These numbers indicate that sin tax revenues may continue to increase, as the July-April revenues from alcoholic beverages, marijuana sales and excise taxes, and electronic nicotine devices are greater for fiscal 2024 than fiscal 2023. Declining cigarette tax revenues seem to be heading in the same direction.

With recent legislative initiatives to grant more liquor licenses to restaurants and bring back happy hour in Massachusetts, alcoholic beverage tax revenues may increase even more in coming years. Furthermore, the increased accessibility of online sports betting may propel gambling tax revenues even higher. In the midst of concerns regarding recent revenue shortfalls, sin tax revenues may prove to be a crucial source of revenue down the road.

About the Author

Matt Mulvey is a Roger Perry Transparency Intern at Pioneer Institute. He is a rising senior at Swarthmore College where he is a political science major and history minor.