ACA Premium Roller Coaster for Small Business Coming to Massachusetts

A handful of owners of small companies in the Commonwealth have recently shared with me their deep sense of uncertainty and apprehension about what the ACA will mean for their health insurance premiums. They finally realized that local politicians were not telling the whole story when delivering speeches highlighting some of the similarities between RomneyCare and ObamaCare. In fact, implementation by federal HHS has only served to confuse them further and repeatedly moved the goal posts. The latest example is the ongoing saga of the ACA’s rating factors mandate on the Commonwealth.

Beacon Hill is set to take up a bill on Wednesday that would place Massachusetts on track to be compliant with the federal health care law.

A recently released Division of Insurance (DOI) report on the impact of the ACA rating factors deserves a closer look. Some will be pleasantly surprised by the result, hundreds of thousands will not.

What the report details:

The impact of eliminating some of our current rating factors, a change required by the ACA, and a reality of our state having a merged market for individuals (84,999 lives) and companies with 1-50 employees (634,085 lives).

To be more exact, in 2014, the ACA will force Massachusetts insurance companies to eliminate the following rating factors when offering insurance:

Factors part of Massachusetts’ 2-to-1 rating band:

- Industry of the employer;

- Participation of employees in the employer’s health coverage; and

- Participation in approved wellness programs.

Factors outside the permissible 2-to-1 rating band:

- Size of the employer group;

- Use of an intermediary when obtaining coverage; and

- Use of a group purchasing cooperative when obtaining coverage.

Leaving us with:

- Family composition;

- Ages of the covered members (which may only vary within a 3-to-1 band for adults);

- Tobacco usage of the covered members; and

- Geographic location of the business or the individual policyholder’s residence.

But recent media stories have documented the prohibition of using tobacco utilization as a factor. In other words, we will be left with just three factors, and companies required to report the age of dependents along with their employees.

Takeaways for the DOI report:

- Premiums will go up for roughly 54% (391,838) of individuals and small company employees in the Commonwealth, and down for roughly 327,246. (see charts below)

- The state should be looking to expand our restrictive age banding up to the ACA approved 3:1 from our current 2:1. The rating factor outcomes would be less dramatic to small companies, and is “more fair.”

In other words, older individuals at the top of their earning potential nearing the end of their careers would pay more money for their insurance (better reflecting their likelihood of needing medical care), instead of forcing younger workers at their lowest earning potential to subsidize the insurance premiums of older members of society. This is a matter of fairness, and in this case also better for the aggregate.

- It is the first time it has been publicly acknowledged in a state report that, “many individuals’ and small employers’ premiums will change in material ways as their coverage renews in 2014,” yet the report suffers from numerous limitations. (see end of post for more.)

- Much more public discussion and disclosure is needed on this issue from the state. The state has withheld information on the impact of the new three year transition period, and the impact of demerging the marketplace as an option on premiums.

ACA Rating Factor Changes Impact: Winners and Losers

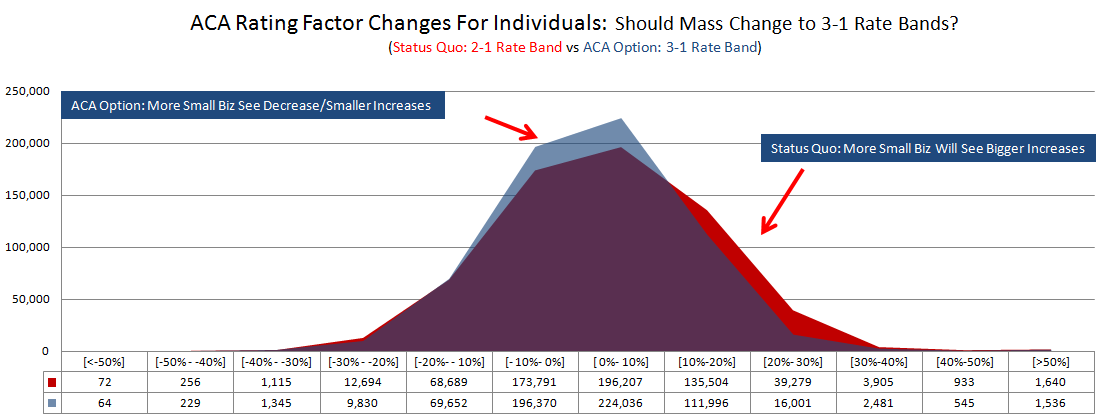

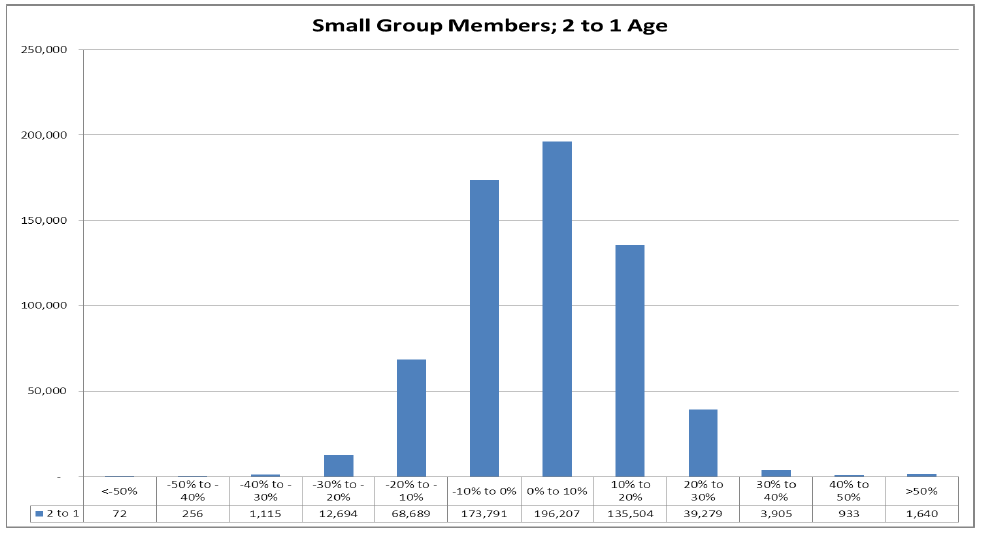

Biggest Losers: 60% (377,468) of small employer members will see premium increases due to the rating factor changes.

Biggest Losers: 60% (377,468) of small employer members will see premium increases due to the rating factor changes.

Increases: 181,000 small employer members will see premiums increase by more than 10%; over 45,757 will see their premiums increase by over 30%.

Smaller Changes: 370,000 small employer members will see premiums increase or decrease between 0% and 10%.

Decreases: 83,000 small employer plan members will see premiums decrease by more than 10%.

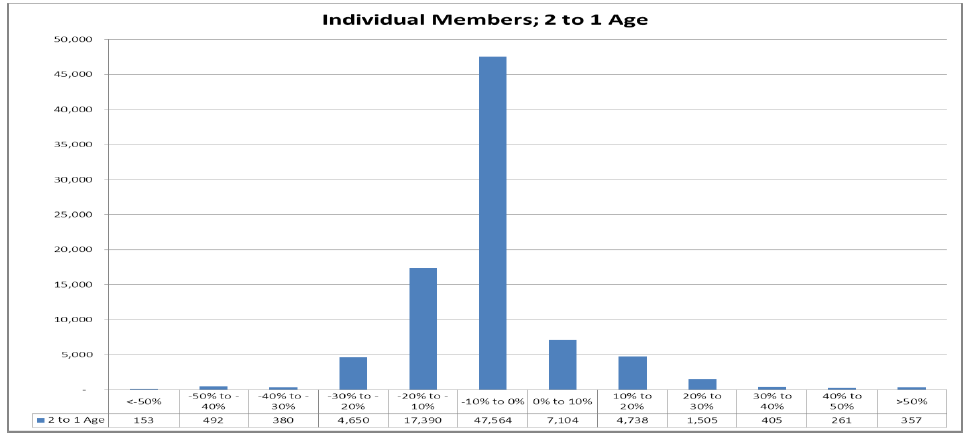

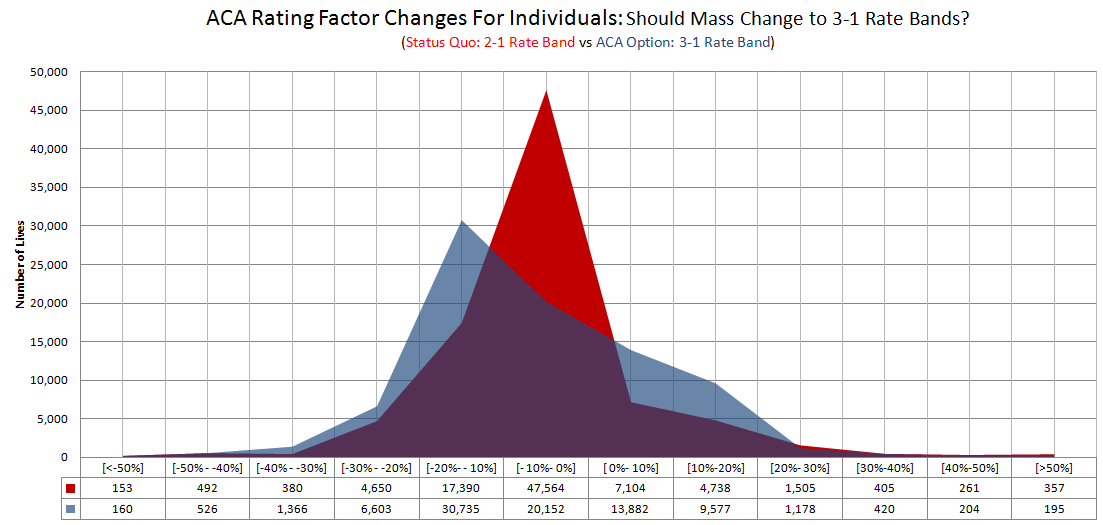

Increases: 14,370 individual premiums will increase. 7,000 individual plan members will see premiums increase by more than 10%; over 2,528 will see their premiums increase by over 20%.

Smaller Changes: 55,000 individual plan members will see premiums increase or decrease between 0% and 10%.

Decreases: 23,000 individual plan members will see premiums decrease by more than 10%

Why Massachusetts Should Consider Expanding its Rate Banding Up to 3:1

Without going into the policy weeds on the specific factors that fall into certain rating bands and which ones don’t, the report explains them clearly, the implications are important.

If Massachusetts accepted the 3:1 rate bands instead of our current 2:1, the premium spikes would moderate and fewer employees would experience “extreme premium increases.” (A phase state officials have used in the past.)

In other words, the highest rate could be up to three times the lowest; instead of the more restrictive band that is current Massachusetts law. Policymakers should give this serious consideration.

We are just learning these details for the first time, and there has been precious little out of the Patrick Administration on the real impact of the ACA, and the trade offs of demerging the marketplace. It is just more of the same—silence.

While 11,000 more individuals will see an increase in premiums with the switch to the 3:1 rate band, most, almost 7,000 would fall in the 0%-10% increase bucket. In addition we have to remember premiums went down for individuals when the markets were merged in 2006 at the expense of small company employers. Perhaps it is time for a compromise.

Finally, there are numerous limitations to keep in mind when considering the DOI report.

The DOI report was out-of-date upon its release, since it only examines the “rules of the road” as of February 27, 2013, before a CMS concocted phase in was granted for rating factors.

Second, the report does not examine the potential impact of unmerging the individual and small group marketplace. Pre-2006, the two markets were separate and any discussion of future policy changes should include a discussion contrasting the scenarios of keeping the status quo versus de-merging the two. The impact on small companies would be dramatically different.

Pioneer Institute has obtained tables from another draft of the report that does just that, but nothing has been released publically to date. The results contained in the non-public tables show hundreds of thousands of small-business employees experiencing double-digit increases, up to 20 percent over the next three years, under the CMS phase in, with many fewer seeing double-digit decreases.

The de-merging scenario shows a more moderate increase on average for those at smaller companies. This point has never entered the public discourse.

Finally, DOI commissioned research (both public and private) have only examined the narrow direct impact of the rating factor changes. Missing from that research, is a consideration of the result of other ACA-required tax increases or changes in insurance design. As a result, small companies have an incomplete picture of what lies ahead. Here is to hoping this will serve as a wake-up call and spurn more transparency and dialogue.

Find me on twitter: @josharchambault