Tag Archive for: tax credit

Earning Full Credit: A Toolkit for Designing Tax-Credit Scholarship Policies

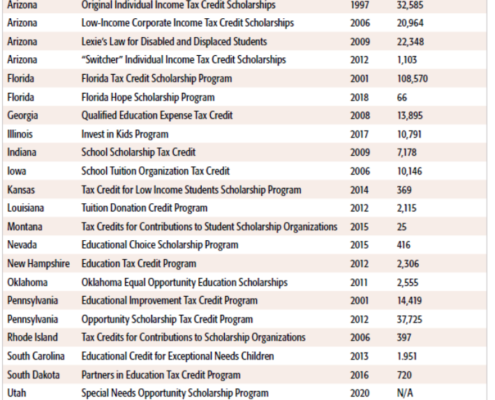

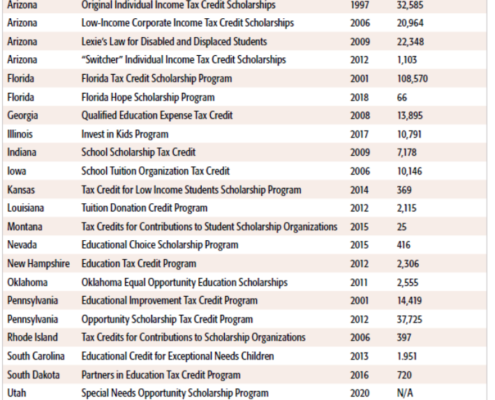

Tax-credit scholarship (TCS) policies create an incentive for taxpayers to contribute to nonprofit scholarship organizations that aid families with tuition and, in some states, other K–12 educational expenses. This paper explores the central design features of TCS policies—such as eligibility, the tax credit value, credit caps, and academic accountability provisions—and outlines the different approaches taken by the TCS policies in each state. The paper also offers suggestions regarding each feature for policymakers who want to design a TCS policy that most likely to succeed at its central purpose: empowering families to provide their children with the education that works best for them.

New Study Provides Toolkit for Crafting Education Tax-Credit Scholarship Programs

In the wake of a U.S. Supreme Court ruling that struck down a key impediment to private school choice, Pioneer Institute has published a toolkit for designing tax-credit scholarship programs. Now available in 18 states, nearly 300,000 students nationwide use tax-credit scholarships to attend the school of their family’s choice. TCS policies create an incentive for taxpayers to contribute to nonprofit scholarship organizations that aid families with tuition and, in some states, other K–12 educational expenses. This paper explores the central design features of TCS policies—such as eligibility, the tax credit value, credit caps, and academic accountability provisions—and outlines the different approaches taken by the TCS policies in each state.

Education Tax Credits: A Review of the Rhode Island Program and Assessment of Possibilities in Massachusetts

0 Comments

/

A Review of the Rhode Island Program and Assessment of Possibilities…