COVID-19’s Impact on Rental Housing

According to a report published on April 8th from the National Multifamily Housing Council (NMHC), about one third of the nation’s apartment residents have not paid their April rent. “The COVID-19 outbreak has resulted in significant health and financial challenges for apartment residents and multifamily owners, operators and employees in communities across the country,” said NMHC President Doug Bibby. “However, it is important to note that a large number of residents met their obligations despite unparalleled circumstances, and we will see that figure increase over the coming weeks.”

Unemployment numbers are escalating to new highs, with 22 million claims since the crisis began, the highest level since 1940. With the majority of our nation’s newly unemployed unable to pay their rent, New York, Governor Andrew Cuomo placed a moratorium on evictions. This is welcome news to the renter, but doesn’t provide answers for landlords who are responsible for mortgage payments and other expenses, as Cuomo’s moratorium only applies to residential mortgages, not commercial loans secured by property. Further, it is not a regulation, just guidance.

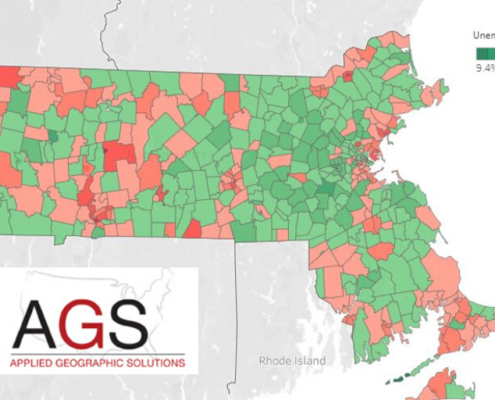

The Massachusetts Legislature is currently debating a rental housing bill, with a six-person panel developing a final version of the bill, which is due on Governor Baker’s desk by Friday, April 17th. Rep. David DeCoste, ranking member of the Joint Committee on Housing, indicated that legislators are close to agreeing on the final provisions of the bill. Current versions provide renters with a lot more rope to delay payments, though Rep. DeCoste believes that for the long term, rent avoidance parameters will be tightened and made clearer.

In a report sent to state legislators by Skip Schloming, executive director of the Small Property Owners Association (SPOA) asserts:

A critical danger lies ahead if any eviction moratorium turns into widespread nonpayment. Evidence already suggests that it is happening. Like the experience of Lawrence after the 1991-92 recession, widespread abandoned housing, and even many torched buildings, could happen across Massachusetts and the country if widespread nonpayment lasts longer than even two or three months.

Schloming adds that “losing rental income from those able to pay not only stops all rental housing maintenance but stops landlords from paying their property taxes. How can cities keep functioning with a very large reduction in their property tax revenues?” He suggests that to best serve both tenants and landlords, the current bill should include provisions for nonpayment by the truly needy, and partial or full payment by those who can afford it.

For many landlords, rental income is their only source of income. They are caught between a rock and a hard place, while they await their rent payment, many of their tenants are awaiting unemployment relief. Nationwide, the majority (22.7 million out of nearly 43.9 million) of occupied rental units are owned by individual investors, according to data from the 2015 Rental Housing Survey. Half of these units are financed by mortgages. Many real estate owners and their lenders are concerned about a mortgage shortfall as a result of non-payment of rent. Another landlord concern is that with so many tenants at home, their operating costs are rising as they deal with more trash and utility usage.

Whether the tenant has lost his or her job, or the landlord has lost rental income, mortgage foreclosures can lead to a disaster for both landlords and tenants. Only a portion of multifamily loans are federally backed through Freddie Mac and Fannie Mae, which are offering mortgage protection to help landlords avoid foreclosure as the crisis continues. However, multifamily coverage accounts for only 39 percent of the federally backed loans.

Additional government assistance programs are also currently out of reach to many small property owners. Under the Coronavirus Aid, Relief, and Stability Act (CARES), most multifamily owners aren’t eligible for paycheck protection loans, since they don’t meet the requirement to dedicate 75 percent of the loan to payroll, which is nearly impossible for small property owners with limited staff.

Perhaps landlords will be able to cover expenses under the additional $250 billion in small business funding that Congress is currently debating how to allocate . Unfortunately, it may be too late for many who can’t float their expenses.

Get Our COVID-19 News, Tips & Resources!

Related Content