Senate Tax Package Misses the Mark on Competitiveness

The Senate tax package, S.2397, is heavy on provisions that reduce the tax burden for certain taxpayers, thereby helping those that qualify for the expanded credits and deductions. The bill, however, is light on provisions that will improve the Commonwealth’s competitiveness.

Debunking Tax Migration Myths

Provisions of Gov. Healey’s $876 million tax package targeted to higher-income earners — including revisions to the estate tax and a reduction in the tax rate for short-term capital gains — are important for encouraging taxpayers subject to them to remain in Massachusetts, according to a new analysis from Pioneer Institute.

Rolling the Retirement Dice: Why the MBTA Should Steer Clear of Pension Bonds

This study illustrates why issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

Tax Flight of the Wealthy: An Academic Literature Review

A new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets. The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal.

As the COVID-19 Pandemic Spurs Consumer Shift to E-Commerce, the Massachusetts Sales Tax Collection System Deserves Renewed Scrutiny

0 Comments

/

At a time when state tax revenues are plummeting, a plan to modernize sales tax collection could get money into state coffers more quickly. This report analyzes the merits of a two-part proposal Governor Baker included in his January state budget submission to streamline state sales tax collections. Sullivan and Mikula find that the first part of Baker’s plan makes sense and is entirely feasible because advances in electronic data processing and electronic funds transfer have eliminated the need for protracted remittance timetables.

Eight more responses to Professor Young—nine really

Pioneer's Greg Sullivan offers a rebuttal to Professor Cristobal Young's criticism of his recent report, "Eight Reasons to Question Professor Cristobal Young's Conclusions about Millionaire's".

Eight Reasons to Question Professor Cristobal Young’s Conclusions about Millionaires

The work of a Stanford University Professor whose research has formed the foundation of efforts, such as one scheduled to appear on the Massachusetts ballot in November, to impose surtaxes on high earners is flawed because it excludes the vast majority of millionaires, according to a new study published by Pioneer Institute.

Housing & Who’s a ‘Millionaire’ according to Proposition 80

The tax hike on those with annual taxable incomes of $1 million or more that would result from a proposed amendment to the state constitution scheduled to appear on the Commonwealth’s November ballot would likely ensnare an ever-increasing number of taxpayers because the index used to adjust the million-dollar threshold has historically grown at a far slower rate than the taxable income of Massachusetts taxpayers and increases in state home values.

Proposition 80 Will Not Raise $2 Billion and The Money Won’t Be Free

Passage of Proposition 80, the tax hike proposal scheduled to appear on the November 2018 Massachusetts ballot, will fail to generate the level of revenue growth projected by its backers.

Will The Wealthy Leave? They Already Are and Proposition 80 Will Only Make it Worse

Passage of Proposition 80, the tax hike proposal scheduled to…

The Federal Tax Reform Act’s cap on deductions of state income taxes has turned Proposition 80 into an economic time bomb for Massachusetts

This report finds that recent passage of the federal tax overhaul legislation will exacerbate the negative economic impact of Proposition 80, the proposed constitutional amendment scheduled to appear on Massachusetts’ November ballot that would add a 4 percent surtax on annual taxable income over $1 million.

The Good, the Bad and the Ugly Eight Patrick Administration Budgets Later

Has Massachusetts made progress towards providing a better quality of life for its residents while maintaining financial stability over the past decade or so? In July 2014, Governor Deval Patrick signed into law the eighth and final budget of his administration with only a few vetoes and recommendations to the General Court. Five years after the financial crisis, this is an opportune moment to review and reflect upon the fiscal state of Massachusetts and what has changed since the beginning of this governorship more than seven years ago.

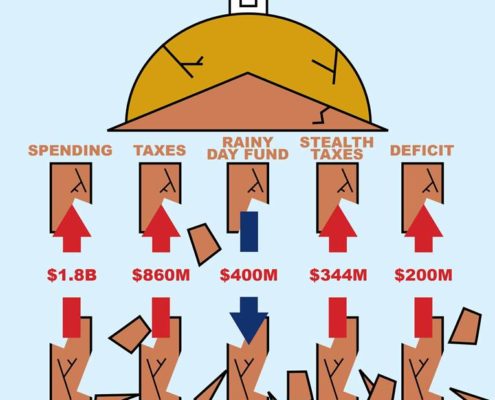

The Good, the Bad and the Ugly: Massachusetts’s 2014 Status Quo Budget

Pioneer has generally produced at the time of release of key budget documents a series of "The Good, the Bad and the Ugly" reports. The conference committee's fiscal year 2014 budget was circulated on the first of the month, just as the new fiscal year started.

Start Here Before Cutting Into the Safety Net

This policy brief recommends $311 million in savings between now and the end of the fiscal year, through emergency and targeted cuts, returning the state workforce to 2004 levels, ending corporate welfare, and consolidating several state functions. By combining these with a $300 million withdrawal from the rainy day fund and a reasonable 4 percent cut in local aid ($200 million), the Governor could avoid further cuts to the safety net and core services.

Hard Decisions, Needed Leadership

This report seeks to identify savings to help close a looming $1 billion to $1.5 billion gap in the Commonwealth's FY09 budget. As a follow-up to a Pioneer press release outlining $600 million in immediate cuts, dated October 8, 2008, we have scoured the budget for savings and reforms, with an eye toward actions that can be undertaken immediately. This report identifies $700 million in budget savings.

Fixing Maintenance in Massachusetts

The horrifying spectacle of the Minnesota bridge collapse has prompted a national reevaluation of the condition of our public infrastructure. In Massachusetts, two recent reports have found a multi-billion dollar backlog of deferred maintenance.

Government Effectiveness Index: A Cross-State Survey

The central objective of the Government Effectiveness Index (GEI) is to assess how Massachusetts is doing in comparison to other states. It seeks to provide measures of effectiveness based on the efficient use of resources (inputs as a function of quantity or output) and on performance outcomes (quality of output). It does so in regard to eight “core” functions of state government (functions common to most states): K-12 education, higher education, highways, transit, state police, the judiciary, corrections, and financial administration.