And What About the T’s Retirement Costs?

Pension and other post-employment benefit (OPEB) costs significantly impact the MBTA’s financial position. There’s been much talk about the T’s retirement costs but relatively little about how those costs and their funding rank among other large transit systems. The MBTA has not set assets aside to fund OPEB obligations and is underfunding its pension costs.

Neither is unusual, but what sets the T is apart is that it is significantly underfunding both.

We reviewed each of the following systems’ 2013 audited financial statements to obtain data (not all systems have yet made 2014 statements available)

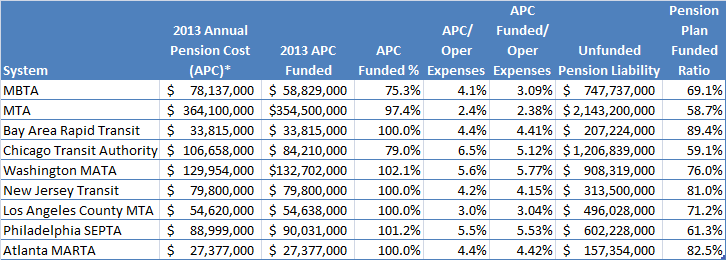

Here’s how the T compares with pension information:

*may include multiple pension plans

The MBTA is the lowest of the largest transit systems in funding its annual pension cost (APC). Underfunding annual pension costs results in a growing liability on its balance sheet and a higher unfunded liability, which is reported in footnotes, rather than on its balance sheet. In 2013, the MBTA funded only 75.3 percent of its APC (fourth column from left), while six of the nine largest systems fully funded the cost. The MBTA ranks seventh of nine when comparing APC and APC funding (fifth and sixth columns from the left) to overall operating expenses. The MBTA’s pension plan funded ratio ranks fourth lowest at 69.1 percent, but the T’s 2008 audited financial statements reported the plan was 94 percent funded at the time – that’s a very significant drop.

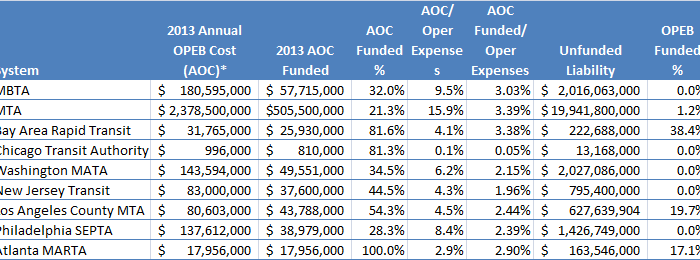

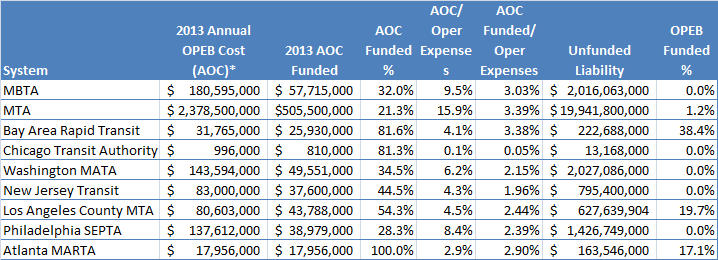

Here’s how the T compares with other post-employment benefit information:

*may include multiple plans.

The MBTA is the third lowest in funding its annual OPEB costs (AOC). Underfunding AOC results in a growing liability and a higher unfunded OPEB liability, which, like underfunded pension benefit obligations, is not reported on its balance sheet. In 2013, the MBTA funded only 32 percent of its AOC (fourth column from left). Of the systems presented, only Atlanta fully funded AOC. At 9.5 percent, the MBTA ranks second when comparing its APC (fifth column from left) as a percentage of operating expenses, but the amount it actually funds is only 3.03 percent of operating expenses. The MBTA, along with five other large systems, have minimal or no assets saved to fund its long-term OPEB obligations – an indictment of the financial stability of all six systems.

Not adequately funding pension and OPEB costs marks a system in distress. Determining a reasonable funding plan is a must to improve the financial condition of the T.