Study Calls For Steps Toward Terminating Troubled MBTA Retirement Fund

Press coverage in The Boston Globe: Report proposes major overhaul of retirement benefits for new MBTA employees and the Boston Business Journal: MBTA urged to end Social Security benefits for employees.

T should transfer fund management to state, assess feasibility of moving employees out of Social Security

BOSTON – The MBTA should assess the feasibility of moving its employees out of the Social Security system and transfer investment management responsibility for its pension fund to the commonwealth’s Pension Reserves Investment Management board as initial steps toward terminating the MBTA Retirement Fund (MBTARF), according to a new study published by Pioneer Institute.

“As the MBTARF’s financial condition continues to worsen, state taxpayers are on the hook even though there is little transparency and no state oversight of the fund,” said Greg Sullivan, co-author of “Fixing the MBTA Retirement Fund: Reforming a Pension Fund in Crisis.” “It’s time to move away from the status quo and toward a system where all employees are treated equally.”

Even though it’s mostly funded by the commonwealth, the MBTARF was created as a private trust. It isn’t subject to state ethics or open meeting laws. Unlike the other 104 public pension funds in Massachusetts, it isn’t overseen by the Public Employee Retirement Administration Commission.

The MBTARF’s unfunded liability has grown from $49 million in 2005 to an estimated $1 billion in fiscal year 2016. The deterioration comes despite rising contributions from the MBTA, which have more than doubled from $38 million in 2007 to $78 million in 2016.

As the unfunded liability rises, so does the contribution needed to keep the fund solvent. The MBTA is responsible for three-quarters of any increase in the annual retired contribution. In fiscal 2016, about $1.3 billion of the T’s $2.03 billion budget came directly from Massachusetts taxpayers.

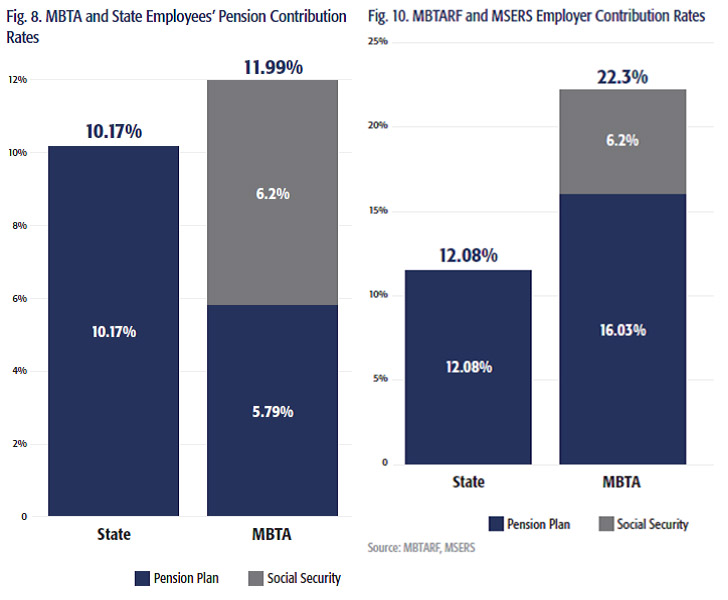

State employees contribute between 9 and 11 percent of their paychecks toward retirement, and the commonwealth kicks in about 12.1 percent. By comparison, MBTA employees contributed 5.8 percent to the MBTARF and the T paid more than 16 percent in 2014, not including Social Security.

Of the seven states in which public employees don’t contribute to Social Security, Massachusetts is the only one with transit workers who are part of the system. Adding in the 6.2 percent employer and employee Social Security contributions, MBTA employees pay 11.99 percent of salary toward retirement and the T supplies 22.2 percent. The 6.2 percent contribution alone cost the MBTA over $30 million in fiscal year 2016.

The MBTARF is also an anomaly in that it isn’t an “integrated” system, meaning employee contributions and the employer match are not reduced to adjust for the presence of the Social Security benefit.

Sullivan and co-authors Matt Blackbourn, Michael Weiner and Iliya Atanasov call for creation of a new “Group T” within the state pension system for new MBTA hires. The new group’s contributions and employer matches would be reduced to equalize their benefits with those of state employees. The new category would also be a step toward eliminating the MBTARF.

In addition to smaller employee contributions and richer benefits, the MBTARF is more generous than the state retirement system when it comes to counting unused sick and vacation time toward pension payout, the ability to cherry pick an employee’s highest-earning years to count toward pension benefits and being able to retire earlier without incurring a penalty.

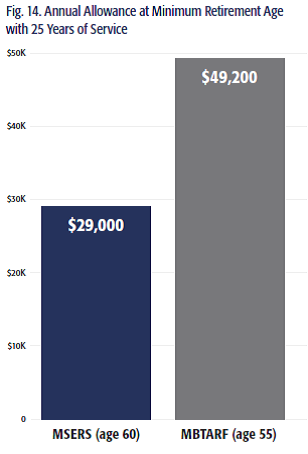

If MBTA and state employees who each earn $80,000 annually and have 25 years of service retire at the earliest possible age (55 for the T employee and 60 for the state worker), the MBTA employee would get a $49,200 annual pension benefit compared to $29,000 for the state worker.

Assuming that each lived to 85, the MBTA worker would collect more than twice as much in total benefits — $1.476 million versus $725,000.

###

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

About the Authors

Gregory W. Sullivan is Pioneer’s Research Director, and oversees the Centers for Better Government and Economic Opportunity. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts, where he directed many significant cases, including a forensic audit that uncovered substantial health care over-billing, a study that identified irregularities in the charter school program approval process, and a review that identified systemic inefficiencies in the state public construction bidding system. Prior to serving as Inspector General, Greg held several positions within the state Office of Inspector General, and was a 17-year member of the Massachusetts House of Representatives. Greg is a Certified Fraud Investigator, and holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

Matt Blackbourn is Pioneer’s Research and Operations Associate. He has led research projects for the Institute’s Center for Better Government, Center for Economic Opportunity and Health Care Initiative. He also assists with managing the organization’s crowdsourcing initiative, the Better Government Competition. Matt holds a Bachelor of Arts degree in Political Science and Philosophy from Tulane University.

Michael Weiner is a Research Assistant at Pioneer Institute and a senior at Northeastern University studying International Affairs through the University Honors Program. He began working at Pioneer as part of Northeastern’s co-op program and has continued as a Research Assistant. Michael previously worked at the Massachusetts Office of Consumer Affairs and Business Regulation and Manna Project International, a non-profit organization in Ecuador.

Iliya Atanasov is Pioneer’s Senior Fellow on Finance, leading research on pension management, budget analysis, infrastructure and municipal performance. Iliya received his PhD in Political Science from Rice University, where he was a Presidential Fellow. He also holds BAs in Business Administration, Economics and Political Science/International Relations from the American University in Bulgaria.

Get Our Fix the T Updates!

Related Research