Is Romneycare A Budget Buster?

The Massachusetts Taxpayers Foundation (MTF) put out a report late last week on the cost of Massachusetts health reform. The number from the report that has gotten the most media attention has been– $91 million.

Over the five full fiscal years since the law was implemented, the incremental additional state cost per year has averaged $91 million…

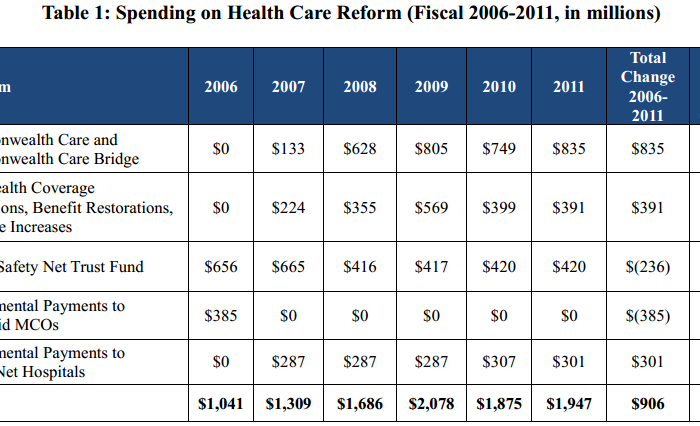

This is a very strange way to interpret the cost data. Here is the breakdown from the report:

The better number to highlight would be the incremental increase each year over the 2006 baseline.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Over 2006 baseline (millions) | – | $268 | $645 | $1,037 | $834 | $906 |

If you add this up and divide by 5, you come up with an average over the 2006 baseline of $738 million, and a state share of $369 million per year. That is a much different story than the $91 million being widely reported.

Context is always needed in cost discussions, so as a reminder Massachusetts was spending roughly $1 billion annually before reform. The state redirected a sizable portion of that money to individuals to allow them to purchase insurance on their own. The reform was expected to cost money, so having some increase each year is expected, but fully understanding the sources can help explain the real story of the reform. For example, I have written on the failed promise to phase out “temporary” safety net hospitals payments before.

My methodology above has its flaws just like the MTF report. It does not account for medical inflation, or for stimulus money that would lower the state share in FY2009, 10, and 11. We both assume a 50% federal match which was not the case in those years.

Pioneer’s recent book The Great Experiment: The States, the Feds, and Your Health Care, explains some issues with these numbers provided by the Governor’s Office.

First, there is no mention of the FY 2009 $1 per pack cigarette tax that was passed to help fund the Commonwealth Care program, or the one-time $50 million assessments imposed on hospitals and insurers. The cigarette tax accounts for roughly $130 million in additional revenue each year.

Second, the calculations don’t include additional expenditures related to the reform law. The ones that immediately come to mind are $25 million of start-up funds for the Connector, or the roughly $12 million a year for community outreach grants, except in FY12.

Thirdly, the current Administration has added to the confusion of cost as it has been broadcasting two different messages.

Nationally, the Governor has been saying the reform has been manageable.

However locally on Beacon Hill, his budget staff and the Legislature have made policy decisions each fiscal year that send a conflicting message. They have cut Medicaid benefits and provider reimbursements, raised taxes, moved certain legal immigrants from the subsidized Commonwealth Care program to a cheaper insurance plan and capped enrollment to save money (which prompted a lawsuit that the state just lost), and have not fully funded to meet the demand in the health safety net or the uncompensated care pool. The MTF report cites the uncompensated care shortfall this year at $130 million. Governor Patrick went as far as to suggest in March 2009 that the state should use $40 million in stimulus funds for rate increases to acute hospitals and an additional $120 in supplemental payments to Cambridge Health Alliance and Boston Medical Center. Of course, all of these actions should not be attributed to the reform, as the economic downturn certainly played a role.

Fourthly, it is somewhat misleading to compare the reform spending to the total state budget. A much better comparison would be the state share of the reform as a percent of the new and redirected spending. This was done in The Great Experiment and instead of 1% of the total state budget being your reference, you see that a more narrow and fair comparison shows that the state is paying just under 20% of the cost of new and redirected money that has paid for reform. (see table)

Finally, this entire discussion of who pays what share is a distraction, as Massachusetts taxpayers pay both state and federal taxes. Ultimately they care about total spending and less about state spending, a fact that is often lost on policymakers and the media.