ACA Medicare Payroll Tax Costs MA $1.7B Over 10 Years; 3 Patriots to Pay $707,850 in 2013

ACA also includes additional 3.8% Medicare tax on net investment income; Bay State residents disproportionately impacted by both

BOSTON – Under the financing provisions of the federal Patient Protection Affordable Care Act (ACA), some Massachusetts residents will face an annual Medicare payroll tax increase of 62%, according to a new Pioneer Institute policy brief, New ACA Medicare Payroll Tax Hits Massachusetts, $1.7 Billion Over 10 Years.

The new study, authored by Pioneer Health Care Policy Director, Josh Archambault, and Pioneer intern, Sadat Donkor, estimates that this one tax increase will cost some Massachusetts wage earners an additional $165,550,909, approximately $1,655,509,087 over 10 years, to help finance the ACA.

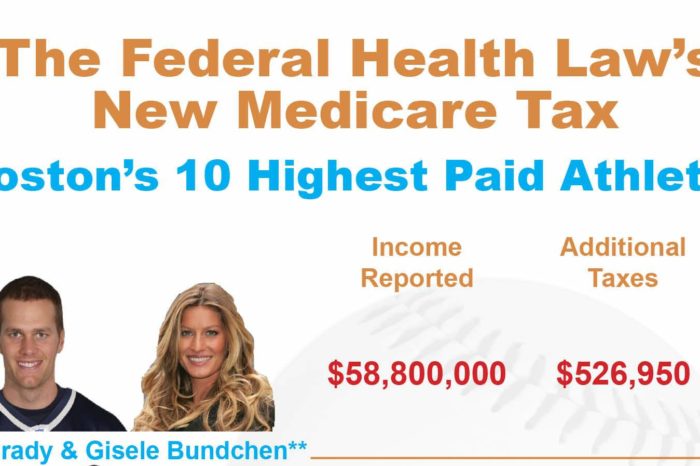

For illustration, Pioneer calculated the impact of this additional Medicare tax on the top ten highest paid athletes (and Gisele Bündchen) in Massachusetts. If the players receive their full wages as reported by Boston Business Journal, these athletes combined will pay close to $1,500,000 a year, and $15,000,000 over 10 years. Tom Brady and Gisele Bündchen will pay roughly $526,950 this year alone.

“As the Patriots kickoff their season, and the federal healthcare law is finishing its preseason, it is important residents in Massachusetts understand the full impact of the new taxes that are part of the law,” said Archambault. “This very small 0.9% new tax packs a powerful punch for many of the athletes in Boston, but more importantly will impact the wallets of tens of thousands in the state by sending $166 million a year more down to Washington, D.C.”

Starting in 2013, the federal government will require all employers to withhold an additional 0.9 percent in Medicare payroll tax (increasing the tax rate from the current 1.45 percent to a permanent 2.35 percent). Unlike “basic” Medicare taxes, this additional tax is paid solely by the employee. It will affect those whose modified adjusted gross income exceeds:

• $250,000 for married taxpayers filing jointly

• $125,000 for married taxpayers filing separately

• $200,000 for individual returns

• $200,000 for head of household (with qualifying persons)

• $200,000 for widow(er)

The ACA also includes an additional Medicare tax on net investment income, a first in our nation’s history, of 3.8 percent on interest, dividends, capital gains, rental income, royalty income, and passive activity businesses. Pioneer’s brief only examines the smaller of the two new taxes, due to the availability of data.

Pioneer has long held that the healthcare policy conversation in the Commonwealth lacks an informed review of the financial consequences of each provision of the ACA. This brief is part of an ongoing series from Pioneer Institute examining the impact on Massachusetts taxpayers and employers. Recent publications include: “First Do No Harm ‘The Impact of the Affordable Healthcare Act on Massachusetts’ Medical Device Industry,’” April 2013, and “Impact of the Federal Health Law’s ‘Cadillac Insurance Tax’ in Massachusetts,” October 2012. In 2012, Pioneer published a timely book, The Great Experiment: the States, the Feds, and Your Healthcare.

###

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.