A Deeper Dive into the Mass Health Reform Waiver & Why it Matters to the Future of the ACA

On December 20th, Governor Deval Patrick, and the entire Massachusetts Congressional delegation, congratulated themselves on the resolution of a six month delayed renewal of the Massachusetts Medicaid waiver. The waiver will run for the next 3 years. I blogged on Pioneer Institute’s website about the recent waiver delay here, here, here, and here. But for those that may not be as familiar, in essence the waiver serves as the foundation for the Massachusetts health care reform.

At first glance at the new waiver, it does appear that the state squeezed substantial sums out of the federal government, but where that money ends up is the critical question. The media largely reprinted the press release, and completely ignored the historical context of the waiver, as well as the most basic breakdown of funding distribution. Below are a few takeaways from the waiver, and an outline for why ongoing issues with safety net hospitals in Massachusetts will potentially explode under the federal Affordable Care Act (ACA). [Sidebar: In my opinion, many elements of the Massachusetts reform do not translate to predictions of behavior at the national scale, but the discussion here highlights one element that will have a direct application.]

The real story of the waiver is the continued funding of safety net hospitals at unsustainable levels, and the lack of reform at these institutions. I came to this conclusion by comparing funding data from the 2011 and 2008 waivers, and by pulling state hospital data from 2010 for the following service and payer categories:

|

Service Category |

Payer |

| Inpatient Discharges

Outpatient Visits Emergency Visits |

|

The waiver and service numbers lead with the following takeaways:

The Waiver Provides a Huge Increase in Funding to Acute Hospitals, with a Majority of Funds Going to Two: Boston Medical Center (BMC) & Cambridge Health Alliance (CHA)

|

2008 Waiver |

2011 Waiver |

|

| Acute Hospital Funding |

$1,090,700,000 |

$2,177,100,000 |

| Funding for Acute Hospitals as % of all Hospital $s |

24% |

49% |

| BMC and CHA % of Acute Hospital Funds, Not including their HSN funds |

63% |

66% |

When you include health safety net (HSN) money, CHA and BMC end up receiving roughly 76% ($1,663,588,000) of the money available to acute hospitals in the 2011 waiver.

It should be noted that the total waiver money available to ALL hospitals did decrease by $200 million from the 2008 to 2011 waiver. However, the cuts were not evenly distributed. While seven acute hospitals were selected in the waiver to receive “Delivery System Transformation Initiative”(DST) funds to the tune of $628 million over 3 years to move away from fee-for-service payment methods, other safety net hospitals and non-acute hospitals will see a much lower percentage of funds as a result, and some see outright cuts. For example, state-owned non-acute hospitals operated by the Department of Mental Health and Department of Public Health will see a $41 million decrease in the aggregate.

If the goal was to help vulnerable hospitals move to a new payment methodology, this waiver failed. The waiver left flexibility to account for new payment reform legislation that may be passed in the next few months on Beacon Hill, and therefore the waiver section on DST methods was left blank. However, one is left to ask how other community and safety net hospitals not named in the waiver will make the transition towards reform if the waiver is built on the assumption that hundreds of millions of additional dollars is required to do so?

|

2011 Waiver |

|

| BMC, without HSN $ |

$466,700,000 |

| CHA, without HSN $ |

$974,600,000* |

| All Other Acute Funding (with all HSN $, BMC & CHA receive ~ 48%) |

$735,800,000 |

| Total Acute Hospital Funding |

$2,177,100,000 |

* $125.5 million was authorized through a demonstration amendment approved on Aug 17, 2011.

BMC and CHA have a disproportionate number of visits and discharges being paid for by the Health Safety Net (HSN), especially for outpatient services. (Note: The percentages for visits and discharges below are in reference to my payer breakdown outlined at the beginning, unless otherwise noted.)

The HSN was formed as part of the 2006 reform, to reimburse hospitals for the care given to the remaining uninsured (currently at ~1.9%). There is no question that BMC and CHA serve a high volume of traditionally challenging populations. These two institutions see 24% of all outpatient & emergency room visits, and inpatient discharges.

Yet, according to the Division of Health Care Finance and Policy, BMC and CHA are not seeing the sickest patient mix. While they see a high volume of patients, the percent of visits for the 5 major payer categories in my analysis look very similar to other hospitals such as Mass General Hospital, or other safety net hospitals such as Quincy Medical Center. However there is one big exception that should worry policymakers—HSN outpatient visits.

|

BMC |

CHA |

|

| % of 2010 Visits and Discharges Paid for by HSN |

18% |

20% |

While the proportion of HSN funded services may not strike some as unusual at first when talking about BMC and CHA, since both do not hide the fact that they serve many HSN patients. However, a further breakdown of the numbers reveals a surprising fact; BMC and CHA are significant outliers in HSN outpatient services.

| Hospital | % of Biz from HSN Outpatient Care, 5 Payer Analysis | HSN Outpatient Visits | HSN Outpatient Visits as a % of All Outpatient Visits at Hospital |

| BMC |

16% |

139,285 |

9.98% |

| CHA |

16% |

67,442 |

10.75% |

| Signature Healthcare Brockton Hospital |

11% |

8,731 |

9.65% |

| Mass General Hospital |

8% |

21,224 |

2.27% |

| Beth Israel Deaconess Medical Center |

7% |

11,176 |

1.59% |

| Steward Carney |

6% |

2,496 |

2.98% |

| Quincy Hospital |

4% |

1686 |

2.72% |

| Lowell General Hospital |

2% |

939

|

.95% |

As an example of the difference in scope for services given to HSN patients at BMC: 1,632 inpatients, 17,501 in the ED, and 139,285 outpatients. BMC accounts for 60% of outpatient HSN visits for the seven hospitals named in the waiver.

Why does this difference in the type of service matter? Outpatient services are often by nature premeditated. This is in direct opposition to the goal of reform in 2006 and is costing taxpayers hundreds of millions of dollars in the process. These major hospitals were going to move away from relying on reimbursement for the uninsured coverage they provided, and see more and more individuals with Medicaid and Commonwealth Care as time passed. Instead, as state lawmakers did not keep their promise to increase Medicaid reimbursement levels over time, it appears CHA and BMC (along with a few others at a much smaller scale) have set up a system that caters to significant numbers of patients that these institutions seek out in order to receive the slightly higher reimbursement from the HSN. Not surprisingly, HSN demand ballooned up to $470 million last year, no doubt due to a down economy, but also because these hospitals have targeted HSN outpatient services. This brings us to the national story–

Massachusetts’ inability to successfully transition safety net hospitals into a more sustainable financing model, should major raise questions about the financing of the national law.

The ACA, is funded, in part, with future cuts in Medicare Disproportionate Share Hospital (DSH) payments. In Massachusetts, a good portion of the money set aside in the now defunct uncompensated care pool was transferred to individuals in the form of subsidies to purchase insurance. The new system promised to be more transparent and economically efficient.

However, BMC and CHA have flexed their political muscle time and time again, receiving temporary “transitional” assistance on multiple occasions. The original reform included special carve outs for these providers, and subsequent waiver renewals have only enforced the status quo. In effect, the federal government is propping up these institutions with state complicity.

The Medicaid waiver struggle has played out three times in Massachusetts, each time proving to be a big lift despite the same party occupying the corner office of the White House each time (Romney and Bush, and Patrick and Obama the last two times). One is left to wonder, if it is such a challenge to move these institutions away from dependence on supplemental transitional government money, how will the process play out with hundreds of billions on the line, a national spotlight, Congressional interest, and seniors impacted by Medicare cuts in the ACA?

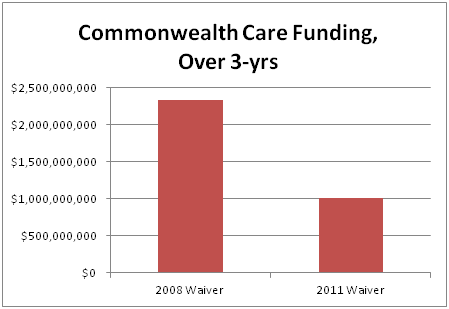

On a final note, the waiver highlights the Major Surgery that is Scheduled for Commonwealth Care. The Commonwealth will receive $1.3 billion less for the program over the next three years compared to the 2008 waiver.

|

2008 Waiver |

2011 Waiver |

|

| CommCare Funding |

$2,333,500,000 |

$1,007,900,000 |

Pioneer has been writing about the coming tidal wave for the Commonwealth Care program for almost a year now, and the waiver flushes this out starkly. A majority of current Commonwealth Care members will be transferred to the Medicaid program, and as a result the Connector currently faces many policy decisions on how best to proceed.

I would welcome your feedback on this blog both in the comment section below or at josh[at]pioneerinst.wpengine.com or on Twitter at @josharchambault