Renters’ Unsung Heroes: Small Landlords Endure Without Income or Relief

Hubwonk host Joe Selvaggi talks with MassLandlords’ Doug Quattrochi about ways landlords faced the challenges of being caught between tenants unable to pay rent during COVID-19 shutdown and having little or no programmatic relief from state and federal agencies.

Jo Napolitano on the Inspiring Stories of Immigrant Children

This week on JobMakers, Host Denzil Mohammed talks with Jo Napolitano, journalist, former Spencer Fellow at Columbia University, and author of the new book, The School I Deserve: Six Young Refugees and Their Fight for Equality in America, about the enterprising spirit of immigrants and refugees across the nation and at the U.S.-Mexico border.

Umesh Bhuju Seeks a Fair Deal for Immigrants, Farmers & the Environment

This week on JobMakers, Host Denzil Mohammed talks with Umesh Bhuju, owner of Zumi’s Espresso in Ipswich, Massachusetts, about how a business model based on selling nothing but fair-trade products can thrive in a world driven by profit. He describes his early experiences in his homeland of Nepal, where he witnessed child labor, and how that has shaped his pursuit of the American dream.

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

Unintended Tax Consequences: Modeling the Effects of the Millionaire’s Tax on Massachusetts’ Economic Future

0 Comments

/

Hubwonk host Joe Selvaggi talks with Beacon Hill Institute President Dr. David Tuerck about his recent analysis of the proposed 4% surtax on incomes over $1 million in Massachusetts, and his estimate of the number of individuals who will leave the state as a result. Tuerck, an economist, used STAMP modeling tools comparing the static projections offered by proponents of the so-called "Fair Share Amendment" with a model simulation that accounts for the unintended effects of the tax.

Dr. Babak Movassaghi on Winning in Football & Healthcare Innovation

This week on JobMakers, Host Denzil Mohammed talks with Dr. Babak Movassaghi, founder of InfiniteMD (acquired last summer by ConsumerMedical), which connects patients with top U.S. medical professionals through second-opinion video consultations, guiding patients to better care. When the world shut down due to COVID-19, Dr. Movassaghi's company was already prepared to serve patients via telehealth. In this episode, they discuss his fascinating pivot from physics and professional football in Germany, to healthcare and innovation here in the U.S., an extension of his ability to navigate multiple identities as an Iranian-German living the American Dream.

COVID-19 and Unemployment Rates in the Cape and Islands

The COVID-19 pandemic has had a large impact on unemployment…

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

Jitka Borowick on Starting a Small Business during COVID

This week on JobMakers, Guest Host Jo Napolitano talks with Jitka Borowick, Founder & CEO of Cleangreen, a cleaning service committed to environmentally-friendly practices, and Nove Yoga, launched during COVID. Jitka grew up under communism in the Czech Republic. Determined to learn English, she made her way to the U.S., initially with plans to stay for only one year - but ended up making it her home. Jitka shares the difficulties of learning another language and culture, her pathway to entrepreneurship, her courageous decision to open a new business during a pandemic, and how her companies have successfully adapted to the challenges so many small businesses have encountered over the past year.

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Proponents of a state constitutional amendment to add a 4 percent surtax on all households with annual income above $1 million frequently cite 2015 data from the Institute on Taxation and Economic Policy, which argues that the Massachusetts tax code is regressive, but a new study published by Pioneer Institute debunks many of the underlying assumptions used in ITEP’s 2015 report.

Josh Feast Answers the Call with AI

This week on JobMakers, Guest Host Jo Napolitano talks with Josh Feast, the CEO and Co-Founder of Cogito, a Boston-based software company that deploys Artificial Intelligence (AI) to help employers in a wide variety of industries improve their customer service call centers. They discuss the many applications of Artificial Intelligence, how it helps provide emotional intelligence to augment management practices at large organizations, and how to address some of the concerns about privacy and bias that have been raised around its use.

Mahmud Jafri Builds on a Pakistani Legacy in America

This week on JobMakers, Host Denzil Mohammed talks with Mahmud Jafri, who built on a legacy started by his grandfather and began importing hand-knitted rugs from his native Pakistan, creating opportunities especially for women who traditionally couldn’t work outside the home. Today, he has three Dover Rug & Home stores across Massachusetts, including the Back Bay.

Pipelines Are Infrastructure: Colonial Incident Reveals Dark Side of Cyber Vulnerability

This week on Hubwonk, Host Joe Selvaggi talks with cyber security expert Dr. Brandon Valeriano about the Colonial Pipeline shutdown and our national exposure to cyberattack on vital infrastructure.

Larry O’Toole on Workplace Culture & Immigration Policy

On this week's episode of JobMakers, host Denzil Mohammed talks to Larry O’Toole, founder of the multi-state Gentle Giant Moving Company that started in 1980 right here in the Boston area. They discuss Mr. O'Toole's journey at a young age from Ireland to Brookline, Mass., the challenges of being uprooted, and the ability to thrive despite barriers such as skills gaps, that many immigrants face.

Fair Share Amendment: Weighing Costs & Benefits for Massachusetts’ Economy & Workers

Hubwonk host Joe Selvaggi talks with Pioneer Institute’s Executive Director Jim Stergios about HB86, the so-called Fair Share Amendment, to tax Massachusetts household income above $1 million. They discuss its promises, its costs, and the effects of similar legislation in other states.

Amar Sawhney on Sikhs, STEM & COVID

On this week's episode of JobMakers, host Denzil Mohammed talks to Dr. Amar Sawhney about his journey from India to Boston, and how he is using his chemical engineering background to save lives through remarkable local therapy innovations. To date, he has founded eight companies accounting for 4,000 jobs and more than $2 billion in revenue.

Study Says Interstate Tax Competition, Relocation Subsidies Exacerbate Telecommuting Trends

A spate of new incentive and subsidy programs seeking to lure talented workers and innovative businesses away from their home states could constitute an additional challenge to Massachusetts’ economic and fiscal recovery from COVID-19, according to a new study published by Pioneer Institute.

Max Faingezicht on the Skills Gap & the Future of Work

This week on JobMakers, host Denzil Mohammed talks with Max Faingezicht, an immigrant who founded ThriveHive, a marketing software company for small businesses, and Telescoped, which uses remote software engineering to connect Latin American engineers with U.S. companies in need of their skills. The entrepreneurial ecosystem of Boston and Cambridge have allowed Max to achieve dreams he didn’t even know he had when he arrived. In this episode, he shares his fascinating immigration story, as well as his ideas on where workers go next.

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs

Pioneer Institute's Statement before the Joint Committee on Revenue In Opposition to: HB 86 (Pages 1-4), a legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

A state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union adding a 4 percent surtax to all annual income above $1 million could devastate innovative startups dependent on Boston’s financial services industry for funding, ultimately hampering the region’s recovery from the COVID-19 economic recession, according to a new study published by Pioneer Institute.

Hilda Torres Makes the Grade

This week on JobMakers, host Denzil Mohammed talks with Hilda Torres, an immigrant from Mexico who runs My Little Best Friends Early Learning Center in Malden, Massachusetts. One of the most successful businesses in the city, the center enrolls over 100 students whose parents come from more than 25 different countries. In this episode, Hilda shares how she used the tools of education, and her own grit and determination, to make her mark in the land of opportunity.

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

Hong Tran Goes from Refugee to Realtor

This week on JobMakers, host Denzil Mohammed talks with Hong Tran, a Worcester, Massachusetts-based realtor and small business owner who emigrated to America as an orphaned refugee from Vietnam.

Sandro Catanzaro Takes His American Dream to Mars and Back

This week on JobMakers, host Denzil Mohammed talks with Sandro Catanzaro, who started several businesses in his native Peru but had no idea he’d end up helping NASA go to Mars, or that he’d use that same technology to plan and buy video ad campaigns. Now Head of Publisher Services Strategy for Roku, which acquired the company he founded, dataxu, in 2019, Mr. Catanzaro is an emblem of ingenuity and inventiveness. His demand-side platform, device graph technology and analytics platform help accelerate Roku’s ad tech roadmap and ability to serve a wide array of advertisers. But he’s not done yet!

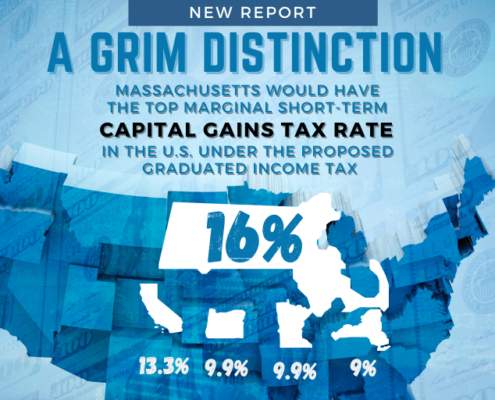

Study: Graduated Income Tax Proposal Fails to Protect Taxpayers from Bracket Creep

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to a new study published by Pioneer Institute.

Christina Qi Goes From Welfare to Wall Street

This week on JobMakers, Host Denzil Mohammed talks with Christina (Chi) Qi, who started a hedge fund at just 22. They discuss her background and journey, moving with her family from China to Utah, being on welfare, and then attending MIT. She went on to co-found Domeyard, a quantitative trading firm, in 2013, among the longest running high-frequency trading hedge funds in the world, and was trading up to $7 billion dollars a day. In 2019, she founded Databento, an on-demand data platform for asset managers and quantitative analysts. They discuss how being an immigrant, Asian, and a woman in the cutthroat, male-dominated world of Wall Street didn’t deter her from success.

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

Herby Duverné Keeps Americans Safe & Gives Back

Welcome to JobMakers, a new, weekly podcast, produced by Pioneer Institute and The Immigrant Learning Center. Host Denzil Mohammed explores the world of risk-taking immigrants, who create new products, services and jobs in New England and across the United States. In the debut episode, Denzil talks with Herby Duverné, CEO at Windwalker Group, an award-winning small business with more than 25 years of experience in physical and cybersecurity solutions that protect and prepare companies through custom learning and training solutions.

Study: Graduated Income Tax Proponents Rely on Analyses That Exclude the Vast Majority Of “Millionaires” to Argue Their Case

Advocates for a state constitutional amendment that would apply a 4 percent surtax to households with annual earnings of more than $1 million rely heavily on the assumption that these proposed taxes will have little impact on the mobility of high earners. They cite analyses by Cornell University Associate Professor Cristobal Young, which exclude the vast majority of millionaires, according to a new study published by Pioneer Institute.

Hoover Institution’s Dr. Eric Hanushek on COVID-19, K-12 Learning Loss, & Economic Impact

This week on “The Learning Curve," Gerard and Cara talk with Dr. Eric Hanushek, the Paul and Jean Hanna Senior Fellow at Stanford University’s Hoover Institution. They discuss his research, cited by The Wall Street Journal, on learning loss due to the pandemic, especially among poor, minority, and rural students, and its impact on skills and earnings.