DCAMM Leasing Responds to Agency Needs

The Division of Capital Asset Management and Maintenance (DCAMM) is a state agency tasked with, among other responsibilities, managing workspace for state employees. This role encompasses the administration of state office buildings, but also includes the management of the Commonwealth’s leases of privately owned buildings.

The agency leases facilities across Massachusetts – and beyond – for the use of the state’s many agencies, from the State Police to the Board of Library Commissioners. DCAMM’s portfolio included 467 separate lease agreements at the end of FY 2015, for buildings in 86 of the Commonwealth’s 351 municipalities, in addition to New York, Chicago, and Washington, DC.

All states make use of a combination of owning and leasing to satisfy their needs, and each method has its advantages and drawbacks. In general, leased space is in the long-term more expensive but also more flexible, and it can be procured or disposed of easily. Ownership, on the other hand, is less expensive in the-long term but requires a fixed commitment. Government is, by nature, amenable to long-term commitments, and DCAMM operates 11 state office buildings across Massachusetts.

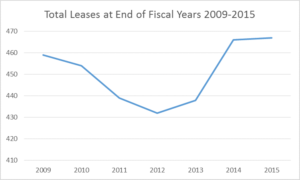

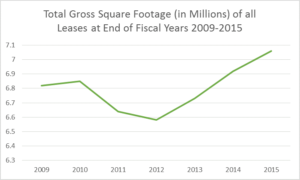

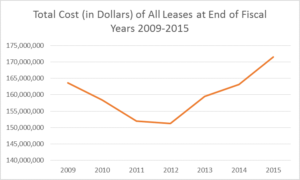

Although the state saw a decline in leasing in the years just following the Great Recession of 2008-2009, the total number of leases has increased since 2012 as the state has taken on increasing amounts of office space at greater cost. Using data from fiscal years 2009-2015, obtained in a public records request, Pioneer has tracked these changes in state leasing behavior, and they are summarized in the graphs below.

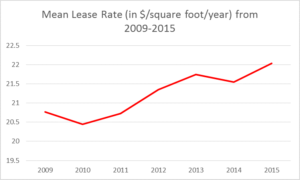

The mean lease rate indicator (shown in red) is an average of the 467 annual lease rates, and so is beholden to regional cost variations that produce outliers. For example, the Department of Revenue’s Manhattan office has a lease rate of $105.06 per square foot per year. A better aggregate measure of cost can be found by dividing total annual cost by total square footage. This figure increased from a low of $22.89 per square foot in 2011 to $24.28 in 2015. This 6.07 percent increase outpaced inflation over the same period.As these graphs show, every indicator has increased from post-Recession lows, including the total number of DCAMM lease agreements, the total amount of square footage leased, the total annual cost to Massachusetts, and the average lease rate.

Massachusetts is leasing more square feet than it has in the past, and is paying higher rates for space, all while the total number of leases (and thus administrative burden) has risen to a post-recession high. Each of these trends points to higher costs, and we expect that 2016 data will continue to follow this pattern.

While the amount of space the Commonwealth leases has increased, there is no evidence of significant disposition of existing state-owned buildings. State employment, meanwhile has remained effectively steady, in fact declining slightly over the past 5 years.

DCAMM publishes guidelines regarding space use for state agencies, including that, “First, the Agency should determine whether there is state space available to meet its needs.” This demonstrates a departmental commitment to the utilization of state space as a primary option. If DCAMM is approving more leases, we must assume that there is not vacant space in state office buildings.

Thus, the state is neither leaving state buildings vacant nor selling them, and is not adding new employees. What then, is the impetus for expansion of gross square footage (GSF) through aggressive leasing?

The division of leased space by state agency may help to shed light on this issue. The state’s 5 largest lessee agencies are show in the table below.

| Top 5 State Lessee Agencies, FY 2015 | |

| Agency | Total Gross Square Footage |

| Trial Court | 1,192,184 |

| Department of Transitional Assistance | 475,962 |

| Department of Developmental Services | 281,339 |

| Massachusetts Rehabilitation Commission | 225,847 |

| Committee for Public Counsel Services | 208,781 |

The agencies that lease the most space tend to follow a pattern: they require large numbers of field offices in many municipalities statewide, and must therefore lease space in smaller cities and towns where state office space may not be available. An increase in demand for these kinds of spaces could conceivably be a driver of the lease expansion, as state space is not an option in most cases. Among departments with more than 10 active lease agreements (as of 2011), several have seen major increases in leased space from 2011 to 2015, while others have seen decline—sometimes steep.

| Percent Change in Leased Space, 2011-2015, Among Selected Agencies | |||

| Agency | 2011 GSF | 2015 GSF | Percentage Change |

| Committee for Public Counsel Services | 112,991 | 208,781 | 84.77% |

| Department of Children and Families | 630,406 | 715,773 | 13.54% |

| Department of Developmental Services | 218,563 | 281,339 | 28.72% |

| Department of Mental Health | 62,740 | 71,911 | 14.62% |

| Department of Transitional Assistance | 496,603 | 475,962 | -4.15% |

| Department of Transportation | 211,347 | 174,300 | -17.53% |

| Department of Workforce Development | 104,652 | 48,404 | -53.75% |

| Massachusetts Rehabilitation Commission | 235,807 | 225,847 | -4.22% |

| Trial Court | 1,192,561 | 1,192,184 | -0.03% |

As the table shows, the rate of expansion for some agencies has greatly outpaced the overall rate of 6.44% growth in leased space over the same period. Some of these changes have clear causes: a major Patrick-era reform to the public defender system spurred the rapid expansion of the Committee for Public Counsel Services, for instance.

The ongoing opioid crisis has created unprecedented demands on the Department of Mental Health, among other agencies, while the major issues at the Department of Children and Families have led to a reorganization that seeks to expand the agency and better integrate it into Massachusetts communities.

Together, these 4 agencies added leases amounting to 253,104 square feet from 2011 to 2015 – 59 percent of the 427,780 square foot total increase over that period. A department-by-department analysis shows that the increases in leased space and total cost of leasing at DCAMM over the past several years is primarily driven by a small number of agencies, which either have undergone major reform or have faced operational strain due to the opioid crisis.

In such situations, the utilization of leases is a good idea – they allow the state to react quickly and provide the space that state employees need, where they need it. In the long-term, however, the state must consider cost effectiveness, which may not be best served by leases obtained during rapid, high profile reforms. As the real estate market returns to pre-recession highs, lease prices, especially in the overheated Boston market, will likely continue to rise.

DCAMM has done its job well, and ensured that state employees handling statewide crises are able to implement needed reforms. It should, however, continue to ensure that the state is well positioned to provide space to state employees while preserving efficiency for taxpayers.