Groton’s Tax Base Dilemma

Among 15 peer municipalities, Groton’s commercial tax yield makes up a relatively small percentage of its total tax revenue and general government expenditures. In Groton and similar towns, how does developing a commercial tax base fare in terms of supporting local expenditures and moderating residential and personal property taxes?

MassAnalysis.com provides town-by-town data on an extensive range of parameters, including municipal expenditures, demographics, tax rates and revenue information. The database allows comparative analyses with “peer municipalities,” that rank similarly to a particular city or town across a variety of metrics that can be selected to provide robust, dynamic insight into municipal governments and their differences across Massachusetts.

A pressing issue for Groton residents has been a perception that taxes are high in relation to the level of services the town provides, as evidenced by relatively low levels of non-education spending. Groton’s total per capita expenditures of around $2,586 per resident are below the $3,276-per-resident median among similar towns.

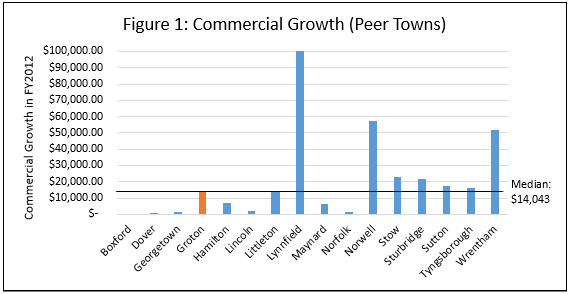

Some attribute this to a lack of commercial development in the area. According to financial and demographic information from MassAnalysis.com, some brief analyses show that although commercial development and growth are low, they are consistent with towns that are similar in terms of demographics and budgetary structures.

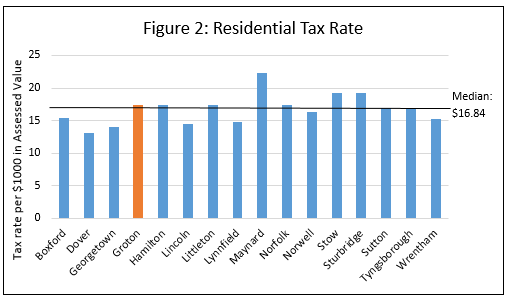

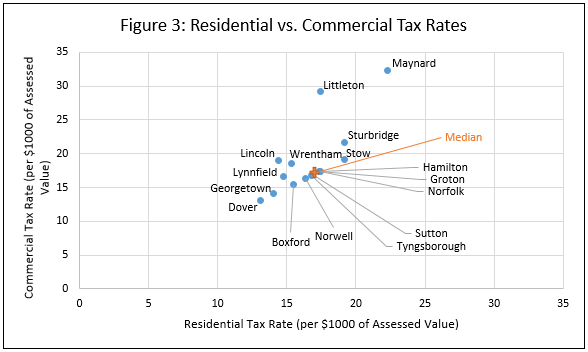

First, Groton is at the median revenue per capita for 15 designated “peer” municipalities, including Tyngsborough, Littleton, Sturbridge, and Wrentham. Local taxes account for 88 percent of total general fund revenues, implying that since there is little commercial development and therefore limited commercial tax revenue, residents fund the bulk of town expenses, which may differ from towns with similar or even higher revenues. Furthermore, Groton’s local residential tax rate is higher than 9 out of 15 of such peers, at $17.38 per $1000 in assessed value.

The commercial tax rate in Groton is similar to those of its peers. However, some of the included municipalities have commercial sectors that generate tax revenues that are up to 20 percent of residential revenues. Some towns, including Sturbridge and Wrentham, also have residential tax rates that are significantly lower than residential rates.

The question is whether it is in Groton’s best interest to attempt to spur commercial development. The first step to answer that question is to get the kind of data that MassAnalysis.com provides.

Groton has faced an ongoing debate over increasing commercial development. Maintaining the town’s historic and natural charm by expanding protected areas must be balanced against limits to commercial development and controlling residential tax rates. The town’s current priorities, laid out in a 2011 Master Plan, echo desires both to preserve the historic character and “open space” qualities in Groton and also to support sustainable economic development, which includes supporting local businesses.

Attempts to expand the tax base through commercial development may be limited by space constraints and zoning regulations. Groton is surrounded by towns with highly developed commercial areas like Westford, Littleton, Acton, and Nashua, New Hampshire. But does Groton want to compete commercially with surrounding towns? Maybe not, but MassAnalysis.com provides the data needed to conduct such an analysis.

Introducing new businesses represents a trade-off with other town priorities, and really comes down to what Groton residents want. In comparison with its peer communities, Groton’s low commercial tax revenues are not outside the norm, nor does it have an abnormally his residential tax rate. Thus, commercial development is one solution to lower taxes in the town, but is it something Groton really wants?

Rebekah Paxton is a 2017 Roger Perry Government Transparency Intern. She is a rising senior at Boston University studying Political Science and Economics.